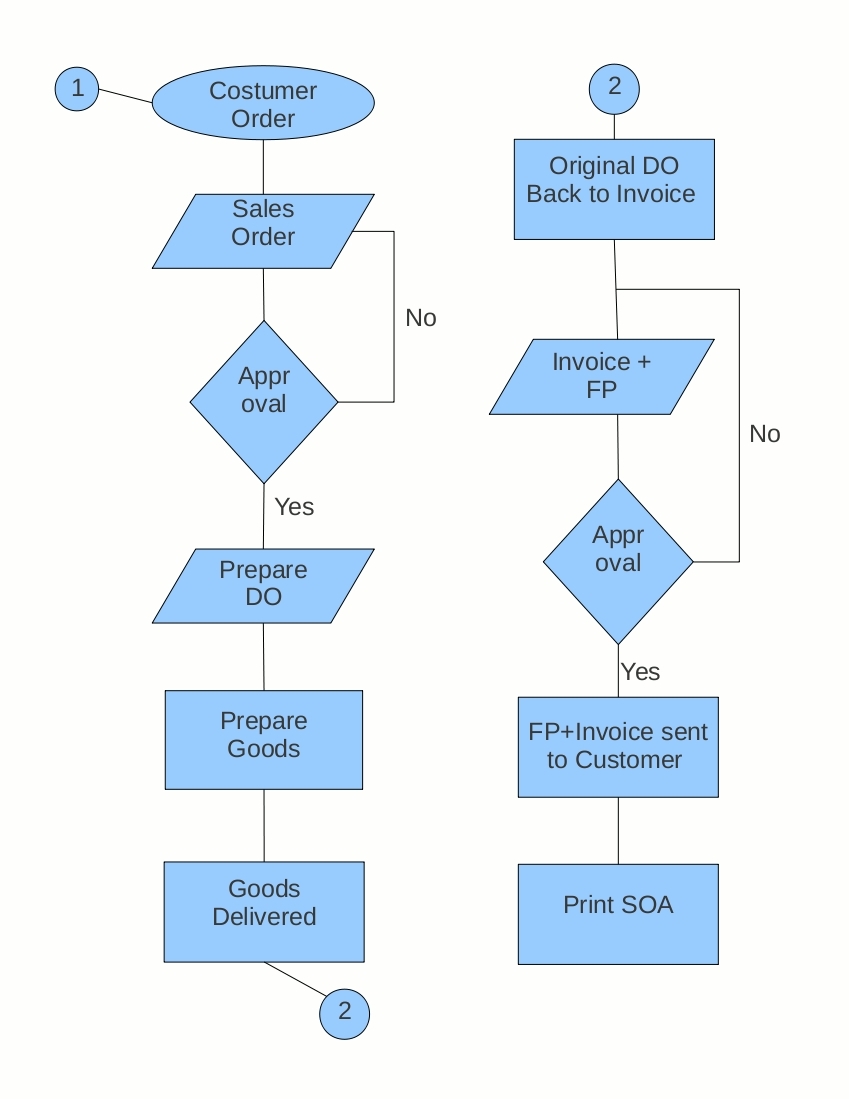

An invoice payment process flow is a set of steps that a business follows to manage and process invoices. It begins when an invoice is received and ends when payment is made. An example of an invoice payment process flow might be: 1) Receive invoice, 2) Review invoice for accuracy, 3) Approve invoice for payment, 4) Issue payment, 5) Record payment.

An efficient invoice payment process flow is essential for any business that wants to maintain good cash flow and avoid penalties for late payments. It also helps to improve relationships with suppliers and vendors. Historically, invoice payment processes were manual and paper-based, which was time-consuming and inefficient. The advent of electronic invoicing and payment systems has greatly streamlined the process.