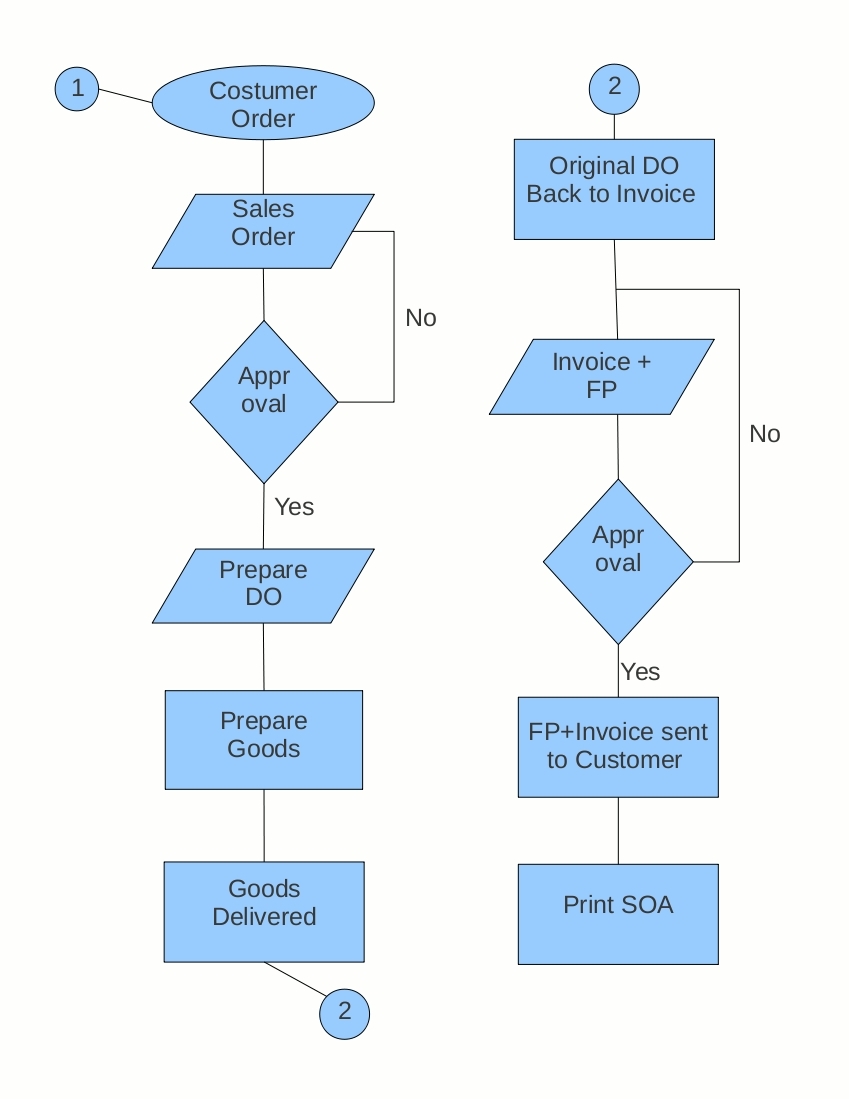

An invoice payment flow chart process is a visual representation of the steps involved in processing and paying supplier invoices. Just as a map helps visualize a route to a destination, an invoice payment flow chart provides an overview of the movement of invoices through your organization from the moment they’re received until they are paid.

This tool plays a crucial role in streamlining financial operations, improving efficiency, and minimizing bottlenecks. It becomes even more valuable as businesses scale and invoice volumes grow. Historically, invoice payment flow charts were manual processes, heavily reliant on paper trails. However, with advancements in technology, businesses can now leverage automated solutions to digitize and streamline this process.