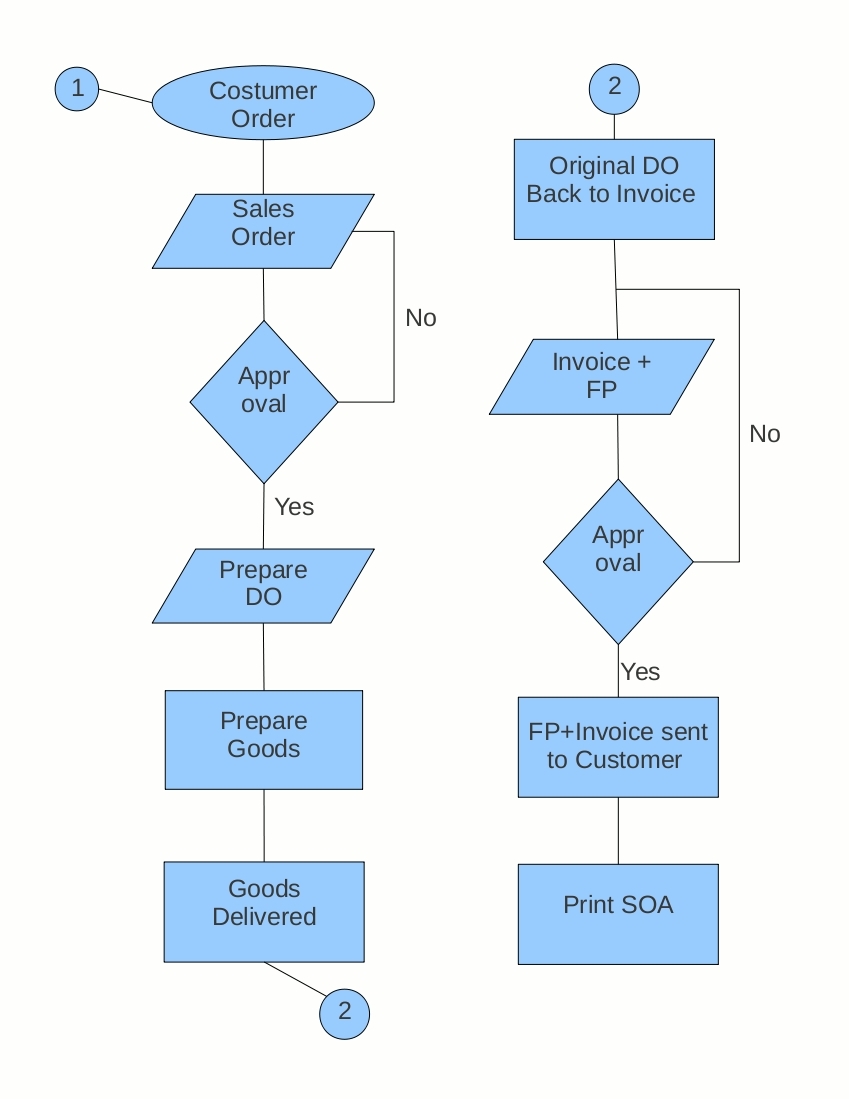

An invoice process flow chart is a visual representation of the steps involved in creating, processing, and tracking an invoice.

This can help businesses improve their invoice processing efficiency and accuracy.

This article will provide a step-by-step overview of the invoice process flow, including guidance on best practices and tips for streamlining the process.

invoice process flow chart – https

An invoice process flow chart is a visual representation of the steps involved in creating, processing, and tracking an invoice. This can help businesses improve their invoice processing efficiency and accuracy.

- Creation

- Approval

- Sending

- Payment

- Tracking

- Reporting

- Storage

- Archiving

These key aspects of an invoice process flow chart are important because they ensure that invoices are created, processed, and tracked efficiently and accurately. This can help businesses improve their cash flow, reduce errors, and improve customer satisfaction.

Creation

The creation of an invoice is the first step in the invoice process flow chart. This step involves gathering the necessary information, such as the customer’s name and address, the products or services provided, the quantities and prices, and the payment terms. Once this information has been gathered, it can be used to create an invoice.

-

Data Gathering

Gathering all the necessary information to create an accurate invoice, including customer details, product or service details, quantities, prices, and payment terms.

-

Invoice Template

Using a pre-defined invoice template to ensure consistency and professionalism, including essential elements like company logo, contact information, and invoice numbering.

-

Invoice Software

Utilizing invoice software to automate the invoice creation process, saving time and reducing errors, with features like customizable templates and automatic calculations.

-

Manual Creation

Creating invoices manually using tools like spreadsheets or word processors, which requires more time and attention to detail, but allows for greater customization and flexibility.

The creation of an invoice is an important step in the invoice process flow chart, as it sets the foundation for the rest of the process. By following these steps, businesses can create accurate and professional invoices that will help them get paid faster.

Approval

Approval is a critical component of the invoice process flow chart. It ensures that invoices are accurate, complete, and authorized before they are sent to customers. This can help businesses avoid errors, delays, and disputes.

There are many different ways to approve invoices. Some businesses use a manual approval process, in which a designated employee reviews and approves each invoice before it is sent. Other businesses use an automated approval process, in which invoices are automatically approved based on predefined criteria.

Regardless of the method used, approval is an important step in the invoice process flow chart. By following these steps, businesses can ensure that their invoices are accurate, complete, and authorized before they are sent to customers.

Sending

Sending is a critical component of the invoice process flow chart. It is the step at which the invoice is transmitted from the seller to the buyer. This step is important because it initiates the payment process and allows the buyer to review the invoice and make payment.

There are many different ways to send an invoice. Some businesses send invoices by mail, while others send them electronically. The method of sending will depend on the preferences of the seller and the buyer.

Regardless of the method used, sending is an important step in the invoice process flow chart. By following these steps, businesses can ensure that their invoices are sent to the correct recipient and that the payment process is initiated.

Payment

Payment is a critical component of the invoice process flow chart. It is the step at which the buyer pays the seller for the goods or services that have been provided. This step is important because it completes the sales transaction and allows the seller to receive payment for their work.

There are many different ways to make a payment. Some businesses accept payments by check, while others accept payments by credit card or electronic transfer. The method of payment will depend on the preferences of the seller and the buyer.

Regardless of the method used, payment is an important step in the invoice process flow chart. By following these steps, businesses can ensure that they receive payment for the goods or services that they have provided.

Tracking

Tracking is a critical component of the invoice process flow chart. It allows businesses to monitor the status of their invoices and payments, and to identify any potential problems. This can help businesses improve their cash flow and reduce their risk of bad debts.

-

Status Tracking

Tracking the status of invoices from creation to payment, including whether they have been sent, viewed, or paid. This allows businesses to identify any delays or issues in the payment process.

-

Payment Tracking

Monitoring the receipt of payments, including the amount, date, and method of payment. This allows businesses to reconcile their accounts and ensure that they have received all of the payments that they are owed.

-

Exception Tracking

Identifying and tracking invoices that have not been paid on time or that have been disputed. This allows businesses to investigate the cause of the problem and take appropriate action.

-

Reporting

Generating reports on invoice and payment activity, such as average days to payment, payment trends, and customer payment history. This information can help businesses identify areas for improvement and make better decisions about their credit and collections policies.

Tracking is an essential part of the invoice process flow chart. By tracking their invoices and payments, businesses can improve their cash flow, reduce their risk of bad debts, and make better decisions about their credit and collections policies.

Reporting

Reporting is an essential component of invoice process flow chart – https://simpleinvoice17.net/invoice-process-flow-chart/ as it allows businesses to track the status of their invoices and payments, identify trends, and make informed decisions. Reporting provides valuable insights into the effectiveness of the invoice process and helps businesses identify areas for improvement.

-

Invoice Aging

Invoice aging reports show the age of outstanding invoices, helping businesses identify overdue invoices and prioritize collection efforts.

-

Payment History

Payment history reports track the payment patterns of customers, enabling businesses to identify customers who consistently pay late or have a history of disputes.

-

Sales Performance

Sales performance reports provide insights into the sales volume and revenue generated by different products or services, allowing businesses to identify top-performing products and services and adjust their sales strategies accordingly.

-

Customer Analysis

Customer analysis reports provide a detailed overview of customer behavior, including their purchase history, payment habits, and communication preferences. This information can be used to tailor marketing and customer service efforts.

Reporting is a powerful tool that can help businesses improve their invoice process flow chart – https://simpleinvoice17.net/invoice-process-flow-chart/ and make better decisions. By tracking key metrics and analyzing the data, businesses can gain valuable insights into their invoice process and identify areas for improvement.

Storage

Storage is a crucial aspect of the invoice process flow chart – https://simpleinvoice17.net/invoice-process-flow-chart/, ensuring the safekeeping, organization, and accessibility of invoice-related documents throughout their lifecycle. It involves maintaining a system for storing and retrieving invoices, credit memos, and other supporting documentation efficiently.

-

Digital Archiving

Storing invoices and related documents electronically in a secure and organized manner, enabling easy retrieval and sharing when needed.

-

Cloud Storage

Utilizing cloud-based platforms to store invoices, providing remote access and ensuring data backup and recovery in case of hardware failures or disasters.

-

Physical Storage

Maintaining physical copies of invoices and supporting documents in a secure and organized manner, serving as a backup and historical record.

-

Document Management Systems

Implementing software solutions to manage invoice storage, retrieval, and tracking, enhancing efficiency and reducing the risk of document loss.

Effective storage practices contribute to the smooth functioning of the invoice process flow chart – https://simpleinvoice17.net/invoice-process-flow-chart/ by ensuring that invoices and supporting documents are readily available for processing, auditing, and retrieval whenever needed. It also helps maintain compliance with legal and regulatory requirements related to invoice storage and retention.

Archiving

Archiving is an essential aspect of invoice process flow chart – https://simpleinvoice17.net/invoice-process-flow-chart/ as it ensures the long-term preservation, retrieval, and accessibility of invoice-related documents. Here are four key facets of archiving in the context of invoice processing:

-

Document Retention

This involves establishing policies and procedures for determining the duration for which invoices and supporting documents should be retained, considering legal, regulatory, and business requirements.

-

Storage Methods

Organizations can choose from various storage methods such as physical archives, digital storage systems, or cloud-based solutions, depending on factors like security, accessibility, and cost.

-

Document Indexing

Proper indexing and organization of archived documents is crucial for efficient retrieval. This can involve using metadata, keywords, or categorizations to facilitate quick and accurate access.

-

Access Control

Establishing appropriate access controls is essential to ensure the confidentiality and integrity of archived documents. This may involve limiting access to authorized personnel only and implementing security measures to prevent unauthorized access.

Effective archiving practices contribute to the smooth functioning of invoice process flow chart – https://simpleinvoice17.net/invoice-process-flow-chart/ by ensuring the availability of critical documents for audits, legal proceedings, or historical reference. It also helps organizations comply with industry regulations and standards related to document retention and archival practices.

Frequently Asked Questions about Invoice Process Flow Charts

This FAQ section provides answers to common questions about invoice process flow charts, covering their purpose, benefits, and implementation.

Question 1: What is an invoice process flow chart?

Answer: An invoice process flow chart is a visual representation of the steps involved in creating, processing, and tracking invoices, providing a clear overview of the entire process.

Question 2: What are the benefits of using an invoice process flow chart?

Answer: Invoice process flow charts can improve efficiency, reduce errors, enhance transparency, facilitate communication, and support compliance with regulations.

Question 3: How do I create an invoice process flow chart?

Answer: Identify the steps in your invoice process, gather relevant information, choose an appropriate diagramming tool, and create a visual representation of the process flow.

Question 4: What are some common challenges in invoice processing?

Answer: Common challenges include manual data entry errors, delays in invoice approvals, lack of visibility into the process, and difficulties in tracking payments.

Question 5: How can I improve my invoice process efficiency?

Answer: Consider automating invoice creation and approval, implementing electronic invoicing, streamlining communication, and regularly reviewing and optimizing the process flow.

Question 6: What are the key elements of an effective invoice process flow chart?

Answer: Focus on clarity, accuracy, completeness, and ease of understanding. Include all essential steps, decision points, and responsibilities, ensuring it aligns with your business requirements.

These FAQs provide a comprehensive understanding of invoice process flow charts, their significance, and practical implementation. By leveraging this information, businesses can optimize their invoice processing for greater efficiency, accuracy, and control.

In the next section, we will delve deeper into the benefits of invoice process flow charts and explore how they can contribute to improved financial management and operational effectiveness.

Invoice Process Flow Chart Tips

Optimizing your invoice process flow chart can significantly enhance your invoice processing efficiency. Here are some practical tips to help you get started:

Tip 1: Identify and Streamline Key Steps: Analyze your existing process and identify areas for improvement. Streamline steps by eliminating unnecessary tasks or combining similar ones.

Tip 2: Use Technology to Automate Tasks: Integrate software tools to automate repetitive tasks such as invoice creation, approval, and payment tracking. This can free up your team’s time for more value-added activities.

Tip 3: Implement Clear Communication Channels: Establish clear communication channels between stakeholders involved in the invoice process. This ensures timely and accurate information flow.

Tip 4: Set: Assign clear deadlines for each step in the invoice process. This helps prevent delays and keeps the process moving smoothly.

Tip 5: Track and Monitor Performance: Regularly track and monitor the performance of your invoice process. Identify bottlenecks and areas for further improvement.

Tip 6: Regularly Review and Update: The invoice process should not be static. Regularly review and update your flow chart to reflect changes in your business or industry best practices.

By implementing these tips, you can create a more efficient and effective invoice process flow chart that supports your business’s financial management and operational success.

In the conclusion, we will discuss how optimizing your invoice process flow chart contributes to overall financial health and operational efficiency.

Conclusion

Optimizing the invoice process flow chart can significantly improve a business’s financial management and operational efficiency. By providing a clear visual representation of the steps involved in creating, processing, and tracking invoices, it enables businesses to identify and streamline key steps, implement technology for automation, and establish clear communication channels. Regular monitoring and review of the process flow chart ensure continuous improvement and alignment with changing business needs.

In summary, an optimized invoice process flow chart leads to increased efficiency, reduced errors, improved transparency, and enhanced compliance. It empowers businesses to manage their finances more effectively, optimize cash flow, and strengthen their overall financial position. Embracing this powerful tool can transform your invoice processing operations and contribute to the long-term success of your business.