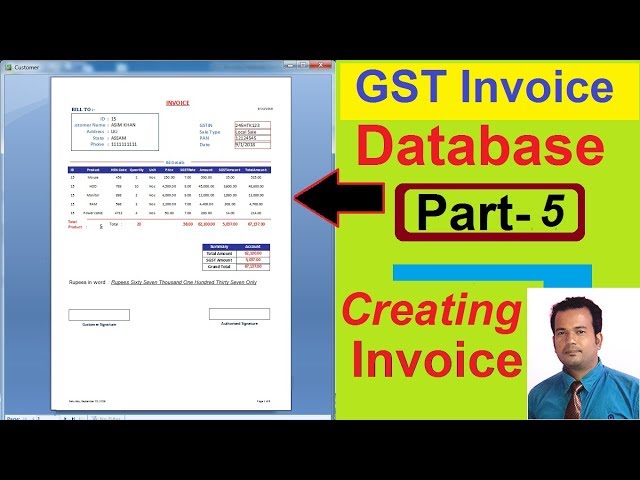

An invoice format – part 5 is a standardized layout and structure used to create invoices, which are essential business documents that detail goods or services provided and the associated charges. It typically includes sections for customer information, invoice number, date, itemized list of products or services, pricing, payment terms, and totals.

Using a consistent invoice format is crucial for efficient record-keeping, clear communication with customers, and streamlining payment processes. Historically, invoices were handwritten or typed, but with the advent of technology, electronic invoicing has become increasingly prevalent, offering benefits such as automation, enhanced security, and improved efficiency.

This article delves deeper into the components of invoice format – part 5, exploring best practices, considerations for effective invoice design, and tips to ensure accurate and timely invoice processing.

Invoice Format – Part 5

When creating an invoice format – part 5, it is essential to consider key aspects that ensure its effectiveness and compliance. These aspects encompass various dimensions, from essential elements to best practices and legal considerations.

- Company Information

- Customer Details

- Invoice Numbering

- Itemization

- Pricing

- Payment Terms

- Legal Compliance

- Design and Layout

- Automation

For instance, clear company and customer information ensures accurate identification and communication. Itemization and pricing should be detailed and accurate to avoid disputes. Payment terms should be clearly stated to manage expectations and ensure timely payments. Legal compliance is essential to adhere to regulations and protect the business. Design and layout impact the invoice’s professionalism and readability. Automation can streamline processes and enhance efficiency. Understanding these aspects and incorporating them into the invoice format – part 5 is crucial for creating effective invoices that facilitate smooth business transactions.

Company Information

Within the context of invoice format – part 5, “Company Information” assumes a pivotal role, acting as the cornerstone for establishing the identity and credibility of the business issuing the invoice. It encompasses essential details that serve as a foundation for clear communication, record-keeping, and legal compliance.

The inclusion of accurate and complete company information on an invoice is not merely a formality but a critical component that facilitates various business processes. Firstly, it enables customers to easily identify the sender of the invoice and establish the context of the transaction. Secondly, it provides a point of contact for inquiries, ensuring prompt and efficient resolution of any queries. Thirdly, company information, including the legal name, address, and contact details, serves as a vital reference for record-keeping purposes, both for the business and its customers.

In practical terms, company information on an invoice serves as a legal document that outlines the terms and conditions of the transaction. It establishes the responsible party for the goods or services provided and facilitates the enforcement of payment obligations. Furthermore, by adhering to legal requirements and including necessary details such as tax identification numbers or business registration information, companies demonstrate compliance and credibility, fostering trust with their customers.

In summary, “Company Information” is an indispensable component of invoice format – part 5, serving as a foundation for clear communication, record-keeping, legal compliance, and establishing the identity and credibility of the business. Its inclusion ensures efficient transactions, facilitates dispute resolution, and promotes adherence to legal requirements, ultimately contributing to smooth business operations.

Customer Details

Within the context of invoice format – part 5, “Customer Details” holds paramount importance as an integral component that directly influences the effectiveness and efficiency of the invoicing process. The inclusion of accurate and complete customer information serves as a foundation for clear communication, streamlined record-keeping, and enhanced customer satisfaction.

The absence of essential customer details can lead to a series of complications and hinder the smooth flow of business transactions. Incorrect or incomplete addresses, for example, may result in delayed or lost invoices, leading to payment delays and potential disputes. Moreover, the lack of proper contact information, such as email addresses or phone numbers, can make it challenging to resolve queries or address concerns promptly. By ensuring that customer details are meticulously captured and maintained, businesses can avoid these pitfalls and foster a seamless invoicing experience.

Real-life examples abound that underscore the significance of accurate customer details within invoice format – part 5. Consider an e-commerce transaction where the customer provides an incorrect email address upon checkout. This oversight can result in the invoice being undelivered, leaving the customer unaware of their payment obligations. Similarly, if a business fails to capture the customer’s correct shipping address, the delivery of goods may be delayed or misdirected, causing inconvenience and potential financial losses.

The practical applications of understanding the connection between “Customer Details” and “invoice format – part 5” are far-reaching. By prioritizing the accuracy and completeness of customer information, businesses can streamline their billing processes, reduce the risk of errors and disputes, and enhance overall customer satisfaction. This understanding also enables businesses to leverage customer data for targeted marketing campaigns and personalized communication, further strengthening their relationships with clients.

Invoice Numbering

Within the realm of “invoice format – part 5,” “Invoice Numbering” emerges as a critical component, serving as a unique identifier for each invoice issued. This seemingly simple aspect plays a pivotal role in streamlining business processes, enhancing record-keeping accuracy, and facilitating efficient tracking of invoices throughout their lifecycle.

The significance of “Invoice Numbering” lies in its ability to establish a systematic approach to invoice management. By assigning a unique number to each invoice, businesses create a centralized reference point that simplifies identification, retrieval, and organization. This structured approach eliminates the risk of duplicate invoices, ensures chronological order for easy referencing, and provides a basis for efficient filing and archiving systems.

In practical terms, “Invoice Numbering” within “invoice format – part 5” offers numerous advantages. It enables businesses to quickly locate specific invoices for inquiries or disputes, reducing the time and effort required for research and retrieval. Moreover, accurate invoice numbering facilitates seamless integration with accounting software, automating processes such as payment tracking and reconciliation, thereby enhancing overall operational efficiency.

To illustrate, consider a business that issues hundreds of invoices monthly. Without a proper “Invoice Numbering” system, managing and tracking these invoices becomes a daunting task, increasing the likelihood of errors and delays. By implementing a unique numbering sequence, the business can effortlessly retrieve invoices based on number, ensuring timely follow-ups and prompt resolution of customer queries.

Itemization

Within the context of “invoice format – part 5,” “Itemization” emerges as a critical component, playing a pivotal role in ensuring clarity, accuracy, and transparency in invoicing practices. Itemization refers to the detailed listing of goods or services provided, along with their respective quantities, unit prices, and total charges, within an invoice.

The significance of “Itemization” lies in its ability to provide a comprehensive breakdown of the transaction, allowing both the sender and recipient of the invoice to have a clear understanding of the charges incurred. By itemizing each line, businesses can avoid confusion or disputes related to the nature and quantity of goods or services provided. Moreover, itemization facilitates accurate calculations of total charges, taxes, and discounts, enhancing the overall credibility and reliability of the invoice.

In practical terms, “Itemization” within “invoice format – part 5” offers numerous advantages. It enables businesses to track the specific goods or services provided to each customer, allowing for tailored billing and customized reporting. Additionally, itemized invoices serve as valuable records for both parties, providing a clear audit trail for financial transactions. This level of detail is particularly crucial in scenarios involving multiple products or services, ensuring that each item is accurately accounted for and priced.

To illustrate, consider a business that provides consulting services to multiple clients. Without proper “Itemization,” the invoice may simply state “Consulting Services: $10,000.” This lack of detail makes it challenging for the client to understand the specific services rendered and their respective charges. By contrast, an itemized invoice would clearly outline the number of hours spent on each task, the hourly rate, and any additional expenses incurred. This transparency fosters trust and reduces the likelihood of disputes or misunderstandings.

Pricing

Within the ambit of “invoice format – part 5”, “Pricing” assumes a position of paramount importance, directly influencing the financial implications and overall effectiveness of the invoicing process. It encompasses various aspects that determine the monetary value of the goods or services provided and serves as a critical factor in shaping customer perception and business profitability.

-

Unit Pricing

Unit pricing refers to the price assigned to a single unit of a product or service. Accurately determining unit pricing is crucial to ensure fair and transparent billing practices, as it forms the basis for calculating total charges.

-

Quantity Discounts

Quantity discounts are price reductions offered to customers purchasing larger quantities of goods or services. Implementing quantity discounts can incentivize bulk purchases, increase sales volume, and enhance customer loyalty.

-

Taxes and Surcharges

Taxes and surcharges are additional charges levied on the base price of goods or services. Understanding and incorporating applicable taxes and surcharges into the invoice pricing is essential for compliance with regulations and accurate invoicing.

-

Payment Terms

Payment terms specify the conditions under which payment is due, including the payment method, due date, and any penalties or incentives for early or late payments. Clearly outlining payment terms on the invoice helps manage cash flow, reduces payment delays, and fosters a positive business relationship with customers.

In summary, “Pricing” within “invoice format – part 5” encompasses a multifaceted approach that involves careful consideration of unit pricing, quantity discounts, taxes and surcharges, and payment terms. By understanding and effectively managing these pricing components, businesses can optimize revenue generation, maintain compliance, and foster mutually beneficial relationships with their customers, ultimately contributing to the success and sustainability of their operations.

Payment Terms

Within the comprehensive framework of “invoice format – part 5”, “Payment Terms” emerge as a crucial component that directly influences the financial dynamics between a business and its customers. These terms outline the conditions under which payment is expected, including the payment method, due date, and any consequences or incentives associated with early or late payments.

The significance of “Payment Terms” in “invoice format – part 5” stems from their ability to establish clear expectations and foster a mutually beneficial financial relationship. By specifying the payment method, businesses can streamline their cash flow management and reduce the risk of payment delays. Furthermore, clearly outlined due dates help customers plan their finances accordingly, avoiding potential penalties or late payment fees.

In real-world applications, “Payment Terms” within “invoice format – part 5” can vary depending on the industry, business practices, and customer agreements. Common payment terms include “Net 30,” which requires payment within 30 days of the invoice date, or “2% 10, Net 30,” which offers a 2% discount if payment is made within 10 days, with the full amount due within 30 days. These terms provide flexibility and incentives for customers, while also ensuring timely payment for businesses.

Understanding the connection between “Payment Terms” and “invoice format – part 5” is essential for businesses to optimize their financial operations. By setting clear and appropriate payment terms, businesses can improve cash flow predictability, reduce payment delays, and foster positive relationships with their customers. Conversely, poorly defined or ineffective payment terms can lead to financial challenges, disputes, and strained business relationships.

Legal Compliance

Within the context of “invoice format – part 5”, “Legal Compliance” emerges as a critical component that ensures adherence to regulatory frameworks and ethical business practices. It encompasses the inclusion of essential legal elements within the invoice format to safeguard the rights and interests of both the issuer and the recipient.

The significance of “Legal Compliance” within “invoice format – part 5” is multifaceted. Firstly, it ensures that invoices meet the minimum legal requirements, such as the inclusion of the seller’s legal name and address, a clear description of goods or services provided, and the total amount due. Secondly, compliance with legal regulations, such as tax laws and consumer protection regulations, helps businesses avoid legal penalties and maintain a positive reputation.

Real-life examples abound that underscore the importance of “Legal Compliance” within “invoice format – part 5”. Consider a business that fails to include the correct tax information on its invoices. This oversight could result in legal penalties and financial losses for the business. Conversely, a business that adheres to legal requirements by including clear terms and conditions, warranty information, and dispute resolution mechanisms protects itself from potential legal disputes.

Understanding the connection between “Legal Compliance” and “invoice format – part 5” is of paramount importance for businesses. By incorporating legally compliant elements into their invoices, businesses can mitigate legal risks, enhance customer trust, and foster a positive business environment. This understanding also allows businesses to stay abreast of changing legal regulations and adapt their invoice formats accordingly.

Design and Layout

Within the ambit of “invoice format – part 5”, “Design and Layout” emerge as critical components that influence the overall effectiveness, readability, and professional perception of invoices. The design and layout of an invoice directly impact the customer’s experience and understanding of the charges incurred, shaping their impression of the business and the transaction.

Effective “Design and Layout” within “invoice format – part 5” ensure that invoices are clear, concise, and visually appealing. A well-designed invoice utilizes white space effectively, employs legible fonts and font sizes, and organizes information logically. By adhering to design best practices, businesses can enhance the readability and comprehension of their invoices, reducing the likelihood of errors or confusion.

Real-life examples abound that demonstrate the impact of “Design and Layout” on “invoice format – part 5”. Consider an invoice that is cluttered with excessive text, lacks visual hierarchy, and utilizes an illegible font. Such an invoice may be challenging to read and understand, potentially leading to payment delays or disputes. Conversely, an invoice with a clean design, ample white space, and a logical layout facilitates easy comprehension and prompt payment.

Understanding the connection between “Design and Layout” and “invoice format – part 5” is essential for businesses seeking to optimize their invoicing processes. By investing in effective design and layout, businesses can enhance customer satisfaction, improve cash flow, and strengthen their professional image. This understanding also empowers businesses to adapt their invoice formats to align with specific industry standards or customer preferences, fostering a positive and efficient invoicing experience.

Automation

Within the realm of “invoice format – part 5”, “Automation” emerges as a transformative force, wielding the power to streamline invoicing processes, enhance efficiency, and drive business growth. Automation encompasses the use of software and technology to automate repetitive and time-consuming tasks associated with invoice creation, processing, and management.

The connection between “Automation” and “invoice format – part 5” is symbiotic. Automation leverages standardized invoice formats to extract data accurately and consistently, enabling automated invoice processing. By eliminating manual data entry and reducing the risk of errors, automation accelerates the invoicing cycle, improves accuracy, and frees up valuable time for businesses to focus on strategic initiatives.

Real-life examples abound that illustrate the power of “Automation” within “invoice format – part 5”. Consider a business that automates its invoice generation process using accounting software. This automation eliminates the need for manual invoice creation, ensuring consistent formatting, accurate calculations, and timely delivery to customers. Another example involves the use of optical character recognition (OCR) technology to automate invoice data capture. OCR software can extract data from paper invoices, eliminating manual data entry and minimizing errors.

The practical applications of understanding the connection between “Automation” and “invoice format – part 5” are far-reaching. Automated invoicing systems can significantly reduce processing time, lower operational costs, and improve overall invoice accuracy. Moreover, automation enhances customer satisfaction by ensuring timely and error-free invoices, fostering positive business relationships. By embracing automation, businesses can gain a competitive edge, improve cash flow, and unlock new opportunities for growth.

Frequently Asked Questions

This FAQ section provides concise answers to common questions and clarifications regarding invoice format – part 5.

Question 1: What are the essential elements of an invoice format – part 5?

Answer: An effective invoice format – part 5 includes essential elements such as company information, customer details, invoice numbering, itemization, pricing, payment terms, and legal compliance.

Question 2: Why is invoice numbering important?

Answer: Invoice numbering plays a crucial role in establishing a systematic approach to invoice management, enabling easy identification, retrieval, and tracking.

Question 3: How does itemization benefit both parties involved in an invoice?

Answer: Itemization provides a detailed breakdown of goods or services, ensuring clarity and reducing disputes, while offering valuable records for both parties.

Question 4: What are the key considerations for pricing in invoice format – part 5?

Answer: Pricing encompasses unit pricing, quantity discounts, taxes and surcharges, and payment terms, which should be carefully determined to ensure fair billing, compliance, and customer satisfaction.

Question 5: Why should businesses prioritize legal compliance in their invoice format?

Answer: Legal compliance safeguards businesses from legal penalties, maintains a positive reputation, and protects the rights of both the issuer and recipient.

Question 6: How can automation enhance invoice format – part 5?

Answer: Automation streamlines invoice creation, processing, and management, reducing manual labor, minimizing errors, and improving overall efficiency.

In summary, understanding invoice format – part 5 empowers businesses to create clear, accurate, and legally compliant invoices that facilitate seamless transactions and foster positive business relationships.

In the next section, we will delve into best practices for optimizing invoice design and layout to enhance readability, strengthen brand identity, and improve the overall customer experience.

Invoice Design Best Practices

Optimizing invoice design and layout is crucial for enhancing readability, strengthening brand identity, and improving the overall customer experience. Here are five best practices to consider:

Tip 1: Use a clear and consistent layout: Employ a consistent structure throughout your invoices, ensuring that essential information is easy to locate and understand. Utilize white space effectively to improve readability and visual appeal.

Tip 2: Employ professional fonts and colors: Choose fonts that are legible and easy on the eyes, avoiding overly decorative or difficult-to-read typefaces. Use colors that align with your brand identity and are appropriate for professional communication.

Tip 3: Highlight important information: Use bolding, italics, or different font sizes to draw attention to critical invoice details such as the invoice number, due date, and total amount. This helps customers quickly identify the most important information.

Tip 4: Include your logo and branding: Incorporate your business logo and branding elements into the invoice design to reinforce brand recognition and establish a professional image.

Tip 5: Provide clear contact information: Make it easy for customers to contact you with any questions or concerns by prominently displaying your business name, address, phone number, and email address.

By following these best practices, businesses can create invoices that are visually appealing, easy to understand, and aligned with their brand identity, ultimately enhancing the customer experience and fostering positive business relationships.

In the next section, we will explore advanced techniques for automating invoice processing, further streamlining operations and improving efficiency.

Conclusion

Throughout this comprehensive exploration of “invoice format – part 5,” we have delved into the essential components, best practices, and advanced techniques that underpin effective invoice management. Understanding the significance of invoice format in streamlining business processes, ensuring accuracy and compliance, and enhancing customer satisfaction is crucial for businesses seeking to optimize their financial operations.

Key points highlighted in this article include the importance of establishing a standardized invoice format that incorporates essential elements such as company information, customer details, itemization, and payment terms. Additionally, we emphasized the benefits of automation in reducing manual labor, minimizing errors, and improving overall efficiency. By embracing these best practices, businesses can create professional and clear invoices that facilitate seamless transactions and strengthen their relationships with customers.