An invoice format for consultancy is a standardized document that outlines the services provided, associated costs, and payment terms for consulting engagements. It serves as a legal record of the transaction between the consultant and the client.

Creating invoices using a consistent format is crucial for efficient billing, accurate record-keeping, and maintaining professional communication. Historically, invoices were primarily paper-based, but the advent of digital solutions has made electronic invoicing more prevalent, offering benefits such as faster processing, reduced errors, and enhanced security.

This article delves into the essential elements of an effective invoice format for consultancy, providing guidance on how to create clear, concise, and compliant invoices that streamline financial processes and foster positive client relationships.

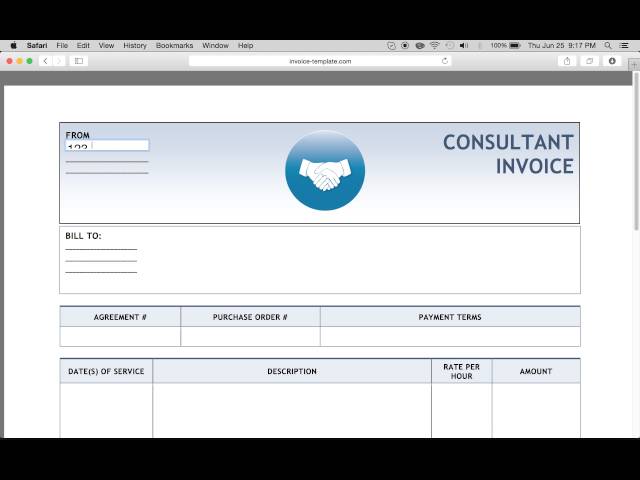

Invoice Format for Consultancy

A well-defined invoice format is crucial for effective billing and efficient financial management in consultancy services. It ensures clarity, consistency, and compliance with legal and professional standards.

These aspects not only streamline billing processes but also contribute to maintaining positive client relationships by providing clear and transparent documentation of services rendered and costs incurred. A well-designed invoice format can enhance the credibility and professionalism of the consultancy, fostering trust and repeat business.

Clarity and conciseness are essential attributes of an effective invoice format for consultancy. They contribute to the overall readability, understanding, and usability of the invoice, ensuring that the information is presented in a straightforward and unambiguous manner.

- Itemized Services: Clearly outline the services provided, their descriptions, and the associated costs. Avoid using vague or general terms that may lead to confusion.

- Accurate Quantities: Specify the quantities of services or deliverables, ensuring that the invoice reflects the actual work completed or products delivered.

- Precise Calculations: Perform calculations accurately and present the total amount due in a clear and prominent location on the invoice. Double-check for any errors to maintain professionalism and credibility.

- Concise Language: Use concise and specific language throughout the invoice, avoiding unnecessary details or jargon that may distract or confuse the reader.

By adhering to these principles of clarity and conciseness, consultancy firms can create invoices that are easy to understand and interpret, fostering transparency, building trust with clients, and streamlining the billing process.

In the context of invoice formats for consultancy, “” (comprehensive detail) plays a critical role in ensuring clarity, accuracy, and transparency. It refers to the practice of providing a thorough and meticulous breakdown of all relevant information on the invoice, leaving no room for ambiguity or misinterpretation.

A comprehensive invoice format for consultancy typically includes the following elements:

- Itemized Services: A clear and detailed description of each service provided, along with the corresponding quantities and unit prices.

- Project Scope: A concise overview of the project or engagement, including its objectives, deliverables, and timeline.

- Payment Terms: A clear statement of the payment due date, accepted payment methods, and any applicable discounts or penalties.

- Contact Information: The contact details of both the consultancy firm and the client, including names, addresses, phone numbers, and email addresses.

By providing comprehensive detail in their invoices, consultancies demonstrate professionalism, enhance transparency, and minimize the risk of disputes or misunderstandings. It also streamlines the billing and payment process, allowing clients to easily verify the accuracy of the invoice and make timely payments.

Professional standards, or “” in Mandarin, are fundamental to the credibility and effectiveness of invoice formats for consultancy. Adhering to these standards ensures that invoices are accurate, transparent, and compliant with legal and ethical guidelines.

- Invoices should be well-organized and easy to understand, with clear headings, descriptions, and calculations.

- All information on the invoice, including service descriptions, quantities, and prices, must be accurate and verifiable.

- Invoices must comply with relevant laws and regulations, including tax regulations and industry-specific requirements.

- Consultants should maintain the highest ethical standards in their invoicing practices, avoiding any deceptive or misleading information.

By adhering to these professional standards, consultancies can enhance the credibility of their invoices, foster trust with clients, and streamline the billing and payment process. Professional invoices not only ensure timely and accurate payments but also contribute to the overall reputation and success of the consultancy.

is a critical aspect of invoice formats for consultancy. It refers to the clear and concise specification of the payment terms, including the due date, accepted payment methods, and any applicable discounts or penalties. Well-defined payment terms streamline the billing process, minimize misunderstandings, and ensure timely payments.

- Due Date: The invoice should clearly state the date by which payment is expected. This helps clients plan their cash flow and avoid late payment fees.

- Payment Methods: The invoice should specify the accepted payment methods, such as bank transfer, check, or credit card. Providing multiple options allows clients to choose the most convenient method for them.

- Discounts: If applicable, any early payment discounts or volume discounts should be clearly stated on the invoice. This encourages timely payments and can foster client loyalty.

- Penalties: Late payment fees or penalties should be outlined in the payment terms. However, these should be reasonable and compliant with relevant regulations.

By incorporating clear payment terms into their invoices, consultancies can streamline their billing processes, reduce the risk of late payments, and maintain positive client relationships. It demonstrates professionalism, transparency, and a commitment to ethical business practices.

is a crucial aspect of invoice format for consultancy. It ensures that all invoices issued by a consultancy firm maintain a consistent and recognizable visual identity, reflecting the firm’s brand values and professional image.

A cohesive invoice format strengthens brand recognition and reinforces the consultancy’s brand identity. It creates a sense of familiarity and trust among clients, as they can easily identify and associate invoices with the firm. This consistency also simplifies invoice processing and reduces the risk of errors, as clients become accustomed to the firm’s invoice layout and terminology.

Real-life examples of in invoice format for consultancy include:

- Using the same logo, color scheme, and typography on all invoices.

- Maintaining a consistent layout and structure for all invoice elements, such as itemized services, payment terms, and contact information.

- Incorporating the firm’s branding elements, such as a tagline or mission statement, into the invoice design.

By implementing in their invoice formats, consultancies can enhance their professional image, streamline invoice processing, and foster stronger relationships with their clients.

Simplifies invoice comprehension and enhances overall clarity, fostering seamless communication between consultancies and their clients. It encompasses several key facets:

- Clear Language: Using straightforward and jargon-free language ensures that the invoice is accessible to a wide range of audiences, promoting ease of understanding.

- Logical Structure: Organizing invoice elements in a logical and consistent manner, with clear headings and subheadings, enhances readability and allows clients to quickly locate specific information.

- Visual Cues: Incorporating visual cues, such as fonts, colors, and white space, can improve the visual appeal of the invoice, making it more visually appealing and easier to navigate.

- Itemized Details: Providing detailed and itemized descriptions of services rendered and expenses incurred promotes transparency and facilitates easy verification of invoice accuracy.

By incorporating these facets into their invoice formats, consultancies can enhance client satisfaction, reduce the risk of disputes, and streamline the billing process. A well-designed invoice that is not only reflects professionalism but also fosters stronger relationships with clients, contributing to the success of the consultancy.

In the context of invoice formatting for consultancy services, “” (Clarity of Project Details) plays a critical role in fostering transparency, accuracy, and efficiency in financial transactions between consultants and clients. A well-defined invoice format that prioritizes clarity of project details enables both parties to have a clear understanding of the services rendered, their associated costs, and the overall project scope.

As a crucial component of an effective invoice format for consultancy, “” ensures that all project-related information is presented in a structured and easy-to-understand manner. This includes providing detailed descriptions of services performed, specifying quantities or units of measurement, and outlining any additional expenses or materials used. By doing so, consultancies can provide their clients with a comprehensive overview of the work completed, allowing for easy verification and validation of invoice accuracy.

In practical terms, “” streamlines the billing process, reduces the risk of disputes or misunderstandings, and fosters trust between consultants and clients. Clear and concise project details enable clients to quickly assess the value delivered and make informed payment decisions. This transparency also helps build credibility and reinforces the professionalism of the consultancy, contributing to stronger client relationships and repeat business opportunities.

In the context of invoice formatting for consultancy services, “” (Numerical Accuracy) plays a crucial role in ensuring the reliability and credibility of financial transactions between consultants and clients. It encompasses various aspects that contribute to the overall quality and effectiveness of the invoice format.

- Decimal Precision: Invoices should accurately reflect numerical values, including monetary amounts, quantities, and measurements. This precision ensures that calculations and totals are correct, avoiding errors or discrepancies that could lead to disputes or misunderstandings.

- Consistent Units: When specifying quantities or measurements, consistency in units is essential. Using the same units throughout the invoice, such as hours, days, or units of product, eliminates confusion and ensures that clients can easily understand and verify the charges.

- Clear Notation: Numerical values should be clearly and consistently notated. This includes using appropriate symbols for currencies, units of measurement, and percentages, as well as aligning numbers correctly to enhance readability.

- Error-checking Mechanisms: To minimize the risk of errors, invoice formats should incorporate error-checking mechanisms, such as formulas or automated calculations, to ensure that totals and subtotals are accurate. This attention to detail reinforces the professionalism and reliability of the consultancy.

By adhering to these principles of numerical accuracy, consultancies can produce invoices that are clear, transparent, and free of errors. This not only streamlines the billing process but also fosters trust and credibility between consultants and clients, contributing to the success and reputation of the consultancy.

Within the context of invoice formatting for consultancy services, “” (Legal Compliance) plays a pivotal role in ensuring that invoices adhere to applicable laws and regulations. It encompasses various aspects that contribute to the overall integrity and validity of the invoice format.

Firstly, legal compliance is a critical component of invoice format for consultancy as it ensures that invoices are accurate, transparent, and free from any misleading or fraudulent information. By adhering to legal requirements, consultancies can avoid potential legal disputes or penalties, maintaining their reputation and credibility. Moreover, legal compliance helps build trust between consultants and clients, as it demonstrates the consultancy’s commitment to ethical and responsible business practices.

Real-life examples of legal compliance within invoice format for consultancy include adhering to tax regulations, such as Value Added Tax (VAT) or Goods and Services Tax (GST), by accurately calculating and including the applicable tax amounts on the invoice. Additionally, complying with data protection laws, such as the General Data Protection Regulation (GDPR), is crucial to protect client confidentiality and privacy when handling personal or sensitive information on invoices.

In practical terms, understanding the connection between legal compliance and invoice format for consultancy empowers consultancies to create invoices that not only meet legal requirements but also align with industry best practices. By incorporating legal compliance into their invoice formats, consultancies can streamline their billing processes, reduce the risk of errors or omissions, and enhance the overall professionalism and credibility of their services.

Within the realm of invoice formatting for consultancy services, “” (Traceability and Archiving) play a crucial role in ensuring the integrity, reliability, and long-term accessibility of invoices. Traceability refers to the ability to track and verify the origin and history of an invoice, while archiving involves the secure storage and preservation of invoices for future reference and retrieval.

Traceability is a critical component of invoice format for consultancy as it establishes a clear audit trail, allowing for easy identification of the source of information, changes made, and the individuals responsible for issuing and approving invoices. This level of transparency is essential for maintaining accurate financial records, preventing fraud, and ensuring accountability within the consultancy.

Real-life examples of traceability within invoice format for consultancy include maintaining a chronological record of invoice numbers, which helps track the sequence and issuance of invoices. Additionally, implementing digital invoicing systems with audit logs provides a detailed history of invoice creation, modifications, and approvals, enhancing traceability and reducing the risk of unauthorized alterations.

In practical terms, understanding the connection between traceability and archiving in invoice format for consultancy empowers consultancies to create invoices that are not only accurate and reliable but also easily retrievable for future reference. By incorporating traceability and archiving into their invoice formats, consultancies can streamline their billing processes, reduce the risk of errors or omissions, and enhance the overall professionalism and credibility of their services.

Frequently Asked Questions

This FAQ section addresses common questions and clarifies important aspects of invoice formatting for consultancy services.

Question 1: What are the essential elements of an effective invoice format for consultancy?

An effective invoice format should include clear identification of the consultancy and client, a detailed description of services rendered, accurate pricing and calculations, payment terms, and contact information for both parties.

Question 2: How can I ensure clarity and conciseness in my invoices?

Use simple and straightforward language, avoid jargon or technical terms, and organize the invoice logically with clear headings and subheadings. Provide specific details about the services provided, including quantities and unit prices.

Question 3: Why is it important to maintain a consistent invoice format?

Consistency in invoice formatting enhances brand recognition, simplifies invoice processing for clients, and minimizes the risk of errors. It also conveys professionalism and attention to detail.

Question 4: How can I improve the accuracy of my invoices?

Double-check all calculations, including quantities, unit prices, and totals. Use clear and precise language to avoid any ambiguity. Consider using automated invoicing tools to minimize errors.

Question 5: What should I do if a client disputes an invoice?

Respond promptly and professionally to any invoice disputes. Review the invoice carefully to identify any errors or misunderstandings. Be willing to make adjustments if necessary, but also stand firm on accurate charges.

Question 6: How can I optimize my invoice format for legal compliance?

Familiarize yourself with relevant tax regulations and industry standards. Ensure that your invoices include all legally required information, such as tax identification numbers and payment terms. Seek professional advice if needed to ensure compliance.

These FAQs provide a foundation for understanding the key aspects of invoice formatting for consultancy services. By addressing these common questions, consultancies can create clear, accurate, and compliant invoices that enhance client satisfaction and streamline billing processes.

In the next section, we will delve deeper into best practices for customizing invoice formats to meet specific client requirements and industry standards.

Tips for Optimizing Invoice Formats

This section provides practical tips to optimize invoice formats for consultancy services, enhancing their clarity, accuracy, and overall effectiveness.

Tip 1: Use clear and concise language: Avoid jargon or technical terms that may confuse clients. Use simple and straightforward language to ensure easy understanding.

Tip 2: Provide detailed descriptions of services: Include specific details about the services rendered, including quantities, unit prices, and any applicable discounts or fees.

Tip 3: Double-check calculations: Ensure accuracy by carefully reviewing all calculations, including quantities, unit prices, and totals. Consider using automated invoicing tools to minimize errors.

Tip 4: Use a consistent template: Maintain a consistent invoice format to enhance brand recognition and simplify invoice processing for clients. Use clear headings and subheadings to organize information.

Tip 5: Include clear payment terms: Specify the payment due date, accepted payment methods, and any early payment discounts or late payment penalties.

Tip 6: Review invoices before sending: Before issuing invoices, thoroughly review them for accuracy, completeness, and compliance with any legal or industry standards.

Tip 7: Use professional invoicing software: Consider using invoicing software to automate invoice creation, track payments, and ensure compliance with tax regulations.

Tip 8: Seek feedback from clients: Regularly request feedback from clients to identify areas for improvement in invoice formatting and payment processes.

By implementing these tips, consultancies can optimize their invoice formats, enhancing clarity, accuracy, and efficiency. This contributes to improved client satisfaction, streamlined billing processes, and a positive brand image.

The following section of the article will discuss best practices for customizing invoice formats to meet specific client requirements and industry standards, further enhancing the effectiveness of consultancy services.

Conclusion

This article has explored the multifaceted aspects of invoice formatting for consultancy services, providing a comprehensive understanding of its significance, best practices, and legal considerations. Throughout this exploration, several key points have emerged:

- Clarity and Accuracy: Clear and concise invoice formats enhance readability, minimize confusion, and ensure accurate billing. This fosters trust and credibility between consultants and clients.

- Legal Compliance: Adhering to legal requirements and industry standards ensures the validity and reliability of invoices. This safeguards against disputes and maintains a positive reputation.

- Customization and Optimization: Tailoring invoice formats to specific client needs and industry practices improves efficiency, streamlines billing processes, and enhances client satisfaction.

In conclusion, invoice formatting for consultancy is not merely a technical exercise but a critical aspect of professional practice. By embracing the principles outlined in this article, consultancies can create invoices that are clear, accurate, legally compliant, and optimized for their unique requirements. This contributes to stronger client relationships, efficient billing processes, and the overall success of consultancy services.