Free contractor invoice forms are digital documents that self-employed individuals and small businesses can use to create itemized bills for their services. They typically include information such as the contractor’s name, contact information, invoice number, date, description of services provided, payment terms, and total amount due.

These forms are essential for contractors as they provide a professional way to track and manage their invoices, ensure timely payments, and streamline their accounting processes. Historically, contractors relied on paper-based invoices, which were often time-consuming to create and could easily get lost or damaged. The advent of free contractor invoice forms has greatly simplified and improved the invoicing process.

This article will provide an in-depth exploration of free contractor invoice forms, including their benefits, key features, and best practices for their use. We will also discuss the latest developments in invoice automation and explore how contractors can leverage technology to streamline their invoicing workflows further.

free contractor invoice forms

Free contractor invoice forms are essential for self-employed individuals and small businesses to manage their finances and get paid for their work. These forms should be clear, concise, and professional, and they should include all of the necessary information to ensure timely payment.

- Essential Aspects of Free Contractor Invoice Forms:

- Company Information: Name, address, contact information

- Invoice Number: Unique identifier for each invoice

- Invoice Date: Date the invoice was created

- Client Information: Name, address, contact information

- Description of Services: Detailed list of services provided

- Payment Terms: When and how payment is due

- Total Amount Due: Total amount of money owed

- Notes: Any additional information that needs to be communicated to the client

By including all of these essential aspects, contractors can create professional invoices that will help them get paid on time and avoid misunderstandings with their clients. For example, clearly stating the payment terms will help to prevent late payments, and including a detailed description of services will ensure that the client understands what they are paying for. Additionally, using a consistent invoice format will make it easier for clients to track and pay their invoices.

Essential Aspects of Free Contractor Invoice Forms

Free contractor invoice forms are essential for self-employed individuals and small businesses to manage their finances and get paid for their work. These forms should include several key aspects to ensure they are clear, concise, and professional.

- Company Information: This includes the contractor’s name, address, and contact information. It is important to include this information so that the client knows who to contact if they have any questions about the invoice or the services provided.

- Invoice Number: This is a unique identifier for each invoice. It is important to include an invoice number so that the client can easily track and reference the invoice.

- Invoice Date: This is the date the invoice was created. It is important to include the invoice date so that the client knows when the invoice is due.

- Client Information: This includes the client’s name, address, and contact information. It is important to include this information so that the contractor knows who to send the invoice to.

By including all of these essential aspects, contractors can create professional invoices that will help them get paid on time and avoid misunderstandings with their clients.

Company Information

When creating free contractor invoice forms, it is important to include the contractor’s company information, including their name, address, and contact information. This information is essential for several reasons.

- Identification: The company name and address help to identify the contractor and their business. This is important for both the client and the contractor, as it ensures that both parties know who they are dealing with.

- Contact: The contact information, which typically includes a phone number and email address, allows the client to easily get in touch with the contractor if they have any questions about the invoice or the services provided.

- Professionalism: Including company information on the invoice form adds a touch of professionalism and shows that the contractor is serious about their business.

- Legal requirements: In some cases, it may be legally required to include the contractor’s company information on invoices. For example, some states require businesses to include their physical address on all invoices.

By including all of the necessary company information on their invoice forms, contractors can ensure that their invoices are clear, concise, and professional. This can help to improve communication with clients, avoid misunderstandings, and get paid faster.

Invoice Number

When creating free contractor invoice forms, it is important to include a unique invoice number for each invoice. This number serves multiple purposes and plays a crucial role in the effective management of invoices and accounts receivable.

Firstly, the invoice number provides a unique identifier for each invoice, allowing for easy referencing, tracking, and organization. It helps contractors keep a clear record of all invoices issued, enabling them to quickly retrieve specific invoices when needed. This is especially useful when dealing with multiple clients and invoices, as it allows for efficient retrieval of invoice details without confusion or errors.

Secondly, the invoice number is essential for accounting and bookkeeping purposes. It allows contractors to easily reconcile payments received with the corresponding invoices, ensuring accurate financial records. By matching invoice numbers to payments, contractors can track income and expenses effectively, maintain proper accounting practices, and generate accurate financial reports.

In addition, invoice numbers are often used as a reference for communication between contractors and clients. When clients have questions or need to make inquiries about a specific invoice, they can refer to the invoice number for easy identification. This helps streamline communication and ensures that both parties are on the same page regarding the invoice in question.

In summary, the invoice number is a critical component of free contractor invoice forms. It provides a unique identifier for each invoice, simplifies invoice tracking and organization, facilitates accounting and bookkeeping, and enhances communication between contractors and clients. By incorporating invoice numbers into their invoice forms, contractors can improve the efficiency and accuracy of their invoicing processes, ensuring timely payments and smooth financial management.

Invoice Date

In the realm of free contractor invoice forms, the invoice date holds significant importance, serving as a crucial component that establishes the timeline of transactions and facilitates efficient financial management. The invoice date signifies the day on which the invoice was created and issued to the client, marking the commencement of the payment period.

Its inclusion on free contractor invoice forms is not merely a formality but rather a critical element that triggers a chain of events. The invoice date sets the due date for payment, which is typically calculated by adding the payment terms to the invoice date. This clarity in payment expectations avoids confusion and potential disputes, ensuring timely payments and smooth financial operations for both contractors and clients.

In real-life scenarios, the invoice date plays a pivotal role in accounting and legal contexts. For contractors, it serves as a reference point for tracking income and expenses, allowing for accurate financial reporting and tax preparation. It also serves as legal documentation in the event of payment disputes or discrepancies, providing a clear record of the invoice’s creation and the agreed-upon payment terms.

Understanding the connection between invoice date and free contractor invoice forms empowers contractors to manage their finances effectively. By adhering to the specified payment terms and promptly following up on overdue invoices, they can maintain a healthy cash flow and avoid financial setbacks. Moreover, clear communication of the invoice date to clients sets realistic expectations and fosters a professional relationship built on trust and transparency.

Client Information

When creating free contractor invoice forms, including accurate and complete client information is paramount. It forms the cornerstone of effective communication and ensures the smooth processing of invoices. The client’s name, address, and contact information serve as essential elements that facilitate efficient invoicing and timely payments.

The client’s name is a fundamental component of the invoice, as it clearly identifies the recipient of the invoice and the party responsible for making the payment. The address, typically comprising the street address, city, and postal code, is crucial for delivering the invoice and any subsequent correspondence related to the transaction. Contact information, including the client’s phone number and email address, enables contractors to reach out to clients promptly to resolve queries, discuss payment arrangements, or follow up on overdue invoices.

In real-world scenarios, accurate client information on free contractor invoice forms streamlines communication and eliminates confusion. For instance, if a contractor needs to contact the client to clarify the scope of work or request additional information, having the correct phone number or email address ensures prompt resolution. Moreover, clear and precise client information minimizes the risk of invoices being lost or misdirected, ensuring timely delivery and reducing delays in payment.

Understanding the significance of client information on free contractor invoice forms empowers contractors to manage their invoicing processes efficiently. By ensuring that all client details are accurately captured and included on the invoice, contractors lay the foundation for smooth financial transactions, foster positive client relationships, and maintain a professional image.

Description of Services

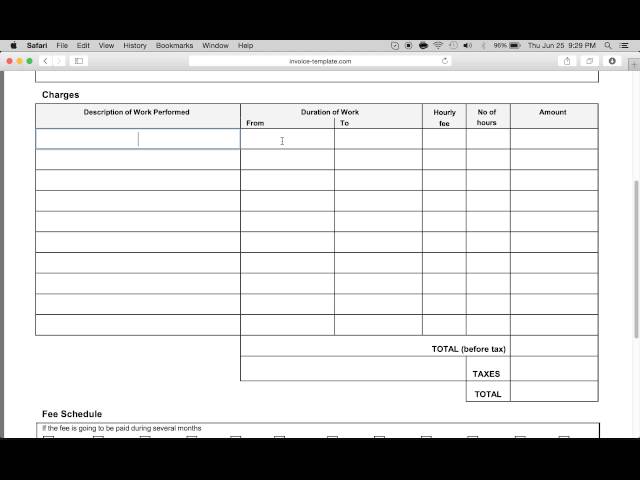

In the realm of free contractor invoice forms, the “Description of Services: Detailed list of services provided” section plays a pivotal role in ensuring clear communication and accurate billing. It provides a comprehensive overview of the services rendered, their scope, and any additional details that may impact the invoice amount.

- Itemized Breakdown: The description of services should include a detailed breakdown of each service provided, including a brief explanation of the work performed, the quantity or duration of the service, and any applicable rates or unit prices.

- Clarity and Precision: The language used in the description should be clear and precise, avoiding vague or ambiguous terms. This helps to prevent misunderstandings and ensures that both the contractor and the client have a shared understanding of the services provided.

- Scope of Work: The description of services should align with the agreed-upon scope of work outlined in the contract or work order. This provides a reference point for both parties and helps to avoid disputes over the services rendered.

- Additional Details: In some cases, the description of services may include additional details such as project milestones, deliverables, or any specific materials or equipment used. These details provide a comprehensive record of the services provided and can be helpful for both parties in the event of any disputes or inquiries.

Overall, the “Description of Services: Detailed list of services provided” section of free contractor invoice forms serves as a crucial component for accurate billing, clear communication, and resolving any potential discrepancies. By providing a comprehensive and well-defined description of the services rendered, contractors can ensure that their invoices are processed efficiently and disputes are minimized.

Payment Terms

In the context of free contractor invoice forms, “Payment Terms: When and how payment is due” is a crucial aspect that outlines the expectations and arrangements for payment between the contractor and the client. It specifies the payment schedule, methods of payment, and any applicable discounts or penalties.

-

Due Date:

This specifies the date by which the payment is expected to be received by the contractor. It can be a fixed date, a number of days after the invoice date, or tied to a specific event or milestone.

-

Payment Methods:

This outlines the acceptable methods of payment, such as bank transfer, check, credit card, or online payment platforms. Contractors may specify preferred methods or offer multiple options for the convenience of their clients.

-

Discounts and Early Payment Incentives:

Some contractors offer discounts for early payment or provide incentives to encourage prompt payment. These terms should be clearly stated to incentivize timely payments and improve cash flow.

-

Late Payment Fees and Penalties:

Contractors may impose late payment fees or penalties if the payment is not received by the due date. These charges are intended to compensate for the additional administrative costs and potential financial impact of late payments.

Clearly defining the payment terms on free contractor invoice forms promotes transparency, sets expectations for both parties, and helps to ensure timely payments. By establishing clear payment arrangements, contractors can mitigate potential disputes, maintain positive client relationships, and improve their financial management.

Total Amount Due

Within the context of free contractor invoice forms, the “Total Amount Due” holds a position of utmost significance, representing the culmination of all charges and fees associated with the services provided. It serves as the centerpiece of the invoice, acting as a concise summary of the financial obligation owed by the client.

The Total Amount Due is a direct reflection of the value delivered by the contractor and forms the basis for payment expectations. Its accuracy is paramount, as it directly impacts the cash flow and financial health of both the contractor and the client. A clear and precise Total Amount Due ensures that both parties are in alignment regarding the financial terms of the transaction.

Real-life examples abound, showcasing the practical implications of the Total Amount Due in free contractor invoice forms. Consider a freelance writer submitting an invoice for a project involving article writing. The Total Amount Due would encompass the agreed-upon rate per word, multiplied by the total word count of the articles delivered. This amount represents the total compensation owed to the writer for their services.

Understanding the connection between the Total Amount Due and free contractor invoice forms empowers contractors to effectively manage their finances and maintain positive client relationships. By accurately calculating and clearly communicating the Total Amount Due, contractors can ensure timely payments, avoid disputes, and project a professional image. It also enables clients to plan their financial obligations accordingly, fostering trust and collaboration.

Notes

Within the realm of free contractor invoice forms, the “Notes: Any additional information that needs to be communicated to the client” section serves as a crucial avenue for conveying supplementary details beyond the core invoice elements. This section allows contractors to provide additional context, clarify expectations, or make special requests, enhancing the overall effectiveness of the invoice.

The Notes section plays a critical role in fostering clear communication between contractors and clients. Through this section, contractors can convey important information that may not fit neatly into other invoice sections. For instance, they can specify project-specific instructions, highlight any deviations from the standard payment terms, or provide updates on the status of ongoing work. By utilizing the Notes section effectively, contractors can minimize misunderstandings, reduce the likelihood of disputes, and ensure that all relevant information is conveyed to the client.

In real-life scenarios, the Notes section of free contractor invoice forms finds practical application in diverse industries and professions. A freelance graphic designer, for instance, may use this section to provide specific color guidelines or image formats for the client’s project. A web developer may use it to outline the login credentials for a newly created website or to provide instructions for accessing project files. These additional notes enhance the clarity and completeness of the invoice, ensuring that the client has all the necessary information at their fingertips.

Understanding the connection between “Notes: Any additional information that needs to be communicated to the client” and free contractor invoice forms empowers contractors to optimize their invoicing processes and strengthen client relationships. By utilizing this section strategically, contractors can provide a comprehensive and informative invoice that meets the specific needs of their clients. Moreover, the ability to include additional notes demonstrates a commitment to clear communication and attention to detail, fostering trust and laying the foundation for long-lasting business relationships.

Frequently Asked Questions (FAQs) about Free Contractor Invoice Forms

This section addresses common questions and concerns regarding free contractor invoice forms, providing clear and concise answers to guide you through their effective use.

Question 1: What are the essential elements of a free contractor invoice form?

A well-crafted invoice should include the contractor’s company information, invoice number, invoice date, client information, a detailed description of services, payment terms, and the total amount due.

Question 2: Why is it important to include a unique invoice number on each form?

Assigning a unique invoice number helps in easy referencing, tracking, and organization of invoices. It also facilitates efficient bookkeeping and serves as a legal reference in case of disputes.

Question 3: What should be included in the “Description of Services” section?

This section should provide a clear and detailed breakdown of the services rendered, including the scope of work, quantity or duration, and any applicable rates or unit prices.

Question 4: How should payment terms be clearly outlined on the invoice?

The payment terms should specify the due date, acceptable payment methods, and any applicable discounts or late payment penalties to avoid confusion and ensure timely payments.

Question 5: What are the benefits of using free contractor invoice forms?

These forms offer several advantages, including professional presentation, improved organization, streamlined accounting, and enhanced credibility in the eyes of clients.

Question 6: Are there any legal considerations when using free contractor invoice forms?

While these forms generally do not pose legal issues, it’s advisable to consult with an attorney to ensure compliance with specific regulations or industry standards in your jurisdiction.

In summary, free contractor invoice forms are essential tools for managing your finances effectively. By understanding the key elements and addressing common questions, you can create professional invoices that facilitate timely payments and strengthen your client relationships.

In the following section, we will delve deeper into the best practices for using free contractor invoice forms to maximize their effectiveness and efficiency.

Tips for Using Free Contractor Invoice Forms Effectively

To make the most of free contractor invoice forms, here are some practical tips to consider:

Tip 1: Use a Professional Template:

Choose a well-designed invoice template that reflects your brand’s professionalism and credibility.

Tip 2: Include Clear Contact Information:

Ensure that your business name, address, phone number, and email address are prominently displayed for easy communication.

Tip 3: Describe Services in Detail:

Provide a detailed description of the services provided, including the scope of work, deliverables, and any specific terms or conditions.

Tip 4: Set Clear Payment Terms:

Specify the payment due date, accepted payment methods, and any applicable discounts or late payment fees to avoid confusion and ensure timely payments.

Tip 5: Use Numbering and Dates:

Assign unique invoice numbers and include the invoice date to maintain organization and for easy referencing.

Tip 6: Keep Records:

Maintain a record of all invoices issued, including copies sent to clients, for accounting and reference purposes.

Tip 7: Track Payments:

Use a system to track payments received and outstanding invoices to stay on top of your accounts receivable.

Tip 8: Seek Professional Advice:

If needed, consult with an accountant or attorney to ensure your invoices meet legal and industry standards.

By following these tips, you can create effective free contractor invoice forms that will streamline your billing process, improve communication with clients, and enhance your financial management.

In the concluding section of this article, we will explore additional strategies for optimizing your invoicing processes and maximizing your earnings as a freelance contractor.

Conclusion

Free contractor invoice forms are essential tools for managing your finances effectively as a freelance contractor. They provide a professional way to track and manage your invoices, ensure timely payments, and streamline your accounting processes.

This article has explored the key elements and best practices for using free contractor invoice forms. By understanding the importance of clear communication, accurate record-keeping, and professional presentation, you can create invoices that will help you get paid faster and build strong relationships with your clients.