Understanding the ‘Difference Between Invoice and Proforma Invoice, Proforma Invoice History, Free Professional Resume Examples 1240 x 1754’ is important for business transactions.

An invoice is a commercial document that itemizes and records a transaction between a buyer and seller. A proforma invoice is a preliminary invoice that outlines the terms of a potential transaction. Proforma invoices are often used to quote prices or request payments before the goods or services are delivered.

This article will explore the key differences between invoices and proforma invoices, the history and benefits of proforma invoices, and provide free professional resume examples. By understanding these distinctions, businesses can optimize their billing processes and ensure accurate financial documentation for each transaction.

difference between invoice and proforma invoice proforma invoice history free professional resume examples 1240 x 1754

Understanding the ‘difference between invoice and proforma invoice, proforma invoice history, free professional resume examples 1240 x 1754’ is essential for business transactions.

- Definition

- Purpose

- Format

- Payment terms

- Taxes

- Legal implications

- Historical context

- Modern applications

These aspects provide a comprehensive understanding of the differences between invoices and proforma invoices, their historical evolution, and their practical applications in various business contexts. For example, understanding the legal implications of invoices is crucial for ensuring compliance and mitigating financial risks. Similarly, exploring modern applications of proforma invoices highlights their role in international trade and e-commerce. By delving into these aspects, businesses can optimize their billing processes, enhance financial transparency, and adapt to changing business environments.

Definition

Understanding the definition of “difference between invoice and proforma invoice proforma invoice history free professional resume examples 1240 x 1754” is fundamental to comprehending the distinctions and relationships between these concepts. It provides a clear understanding of the purpose, structure, and usage of invoices and proforma invoices, as well as their historical evolution and modern applications.

-

Components of Definition

The definition encompasses various components, including the clear distinction between invoices and proforma invoices, their respective roles in business transactions, and their legal implications. It also highlights the historical context and modern applications of these documents.

-

Examples in Practice

In real-world scenarios, the definition helps businesses accurately identify and utilize invoices and proforma invoices. For example, it enables them to distinguish between invoices issued for completed transactions and proforma invoices used for quoting purposes.

-

Implications for Usage

Understanding the definition ensures proper usage of invoices and proforma invoices. It guides businesses in selecting the appropriate document for specific transactions, avoiding errors and ensuring compliance with legal and accounting standards.

-

Historical Evolution

The definition traces the historical evolution of invoices and proforma invoices, showcasing their origins and the changes they have undergone over time. This historical perspective provides context for their current usage and significance in modern business practices.

In summary, the definition of “difference between invoice and proforma invoice proforma invoice history free professional resume examples 1240 x 1754” provides a comprehensive understanding of these concepts, their components, real-life applications, and historical development. It serves as a foundation for further exploration of their purpose, format, payment terms, legal implications, and modern applications in various business contexts.

Purpose

In the context of “difference between invoice and proforma invoice proforma invoice history free professional resume examples 1240 x 1754”, understanding the purpose of each document is crucial for accurate billing and efficient business transactions. An invoice serves as a record of a completed sale, while a proforma invoice outlines the terms of a potential transaction. This distinction impacts their usage, legal implications, and the timing of payments.

-

Documentation of Sale

An invoice serves as legal documentation of a completed sale, itemizing the goods or services provided, their quantities, and the agreed-upon prices. It acts as proof of the transaction and forms the basis for accounting records and tax reporting.

-

Quotation and Payment Request

A proforma invoice presents a quotation for goods or services that have not yet been delivered. It outlines the terms of the potential transaction, including the items, quantities, prices, and payment terms. The purpose is to request payment before the goods or services are provided.

-

Securing Payment

Proforma invoices play a vital role in securing payment, especially in international trade. By providing a clear outline of the transaction, including payment instructions, businesses can reduce the risk of payment delays or disputes.

-

Legal Implications

Both invoices and proforma invoices have legal implications. Invoices serve as legally enforceable contracts, while proforma invoices may be used as evidence of an agreement in the event of disputes.

Understanding the purpose of invoices and proforma invoices is essential for businesses to manage their finances effectively, minimize legal risks, and maintain smooth business relationships with their customers.

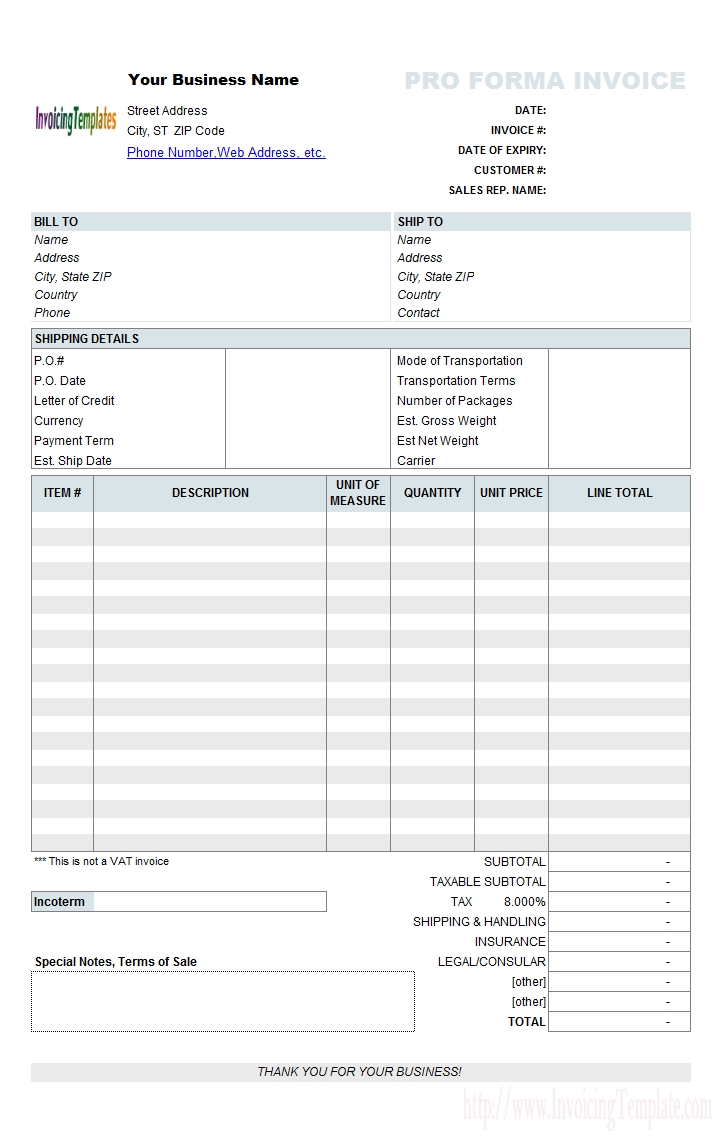

Format

Within the context of “difference between invoice and proforma invoice proforma invoice history free professional resume examples 1240 x 1754”, “Format” refers to the specific structure and layout of invoices and proforma invoices. Understanding the format is crucial for accurate and efficient processing of these documents in business transactions.

-

Mandatory Elements

Invoices and proforma invoices typically include mandatory elements such as the seller’s and buyer’s information, invoice number, date, payment terms, and a description of the goods or services provided.

-

Layout and Design

The layout and design of invoices and proforma invoices can vary depending on industry practices, company preferences, and legal requirements. Some common elements include the use of letterheads, standardized templates, and clear fonts.

-

Digital and Physical Formats

Invoices and proforma invoices can be issued in both digital and physical formats. Digital invoices are increasingly common due to their convenience, cost-effectiveness, and environmental benefits.

-

Legal Implications

The format of invoices and proforma invoices can have legal implications. For example, certain jurisdictions may have specific requirements regarding the inclusion of tax information or the use of specific terminology.

Overall, understanding the format of invoices and proforma invoices is essential for businesses to ensure compliance with legal and accounting standards, streamline billing processes, and avoid errors in financial transactions.

Payment terms

Within the context of “difference between invoice and proforma invoice proforma invoice history free professional resume examples 1240 x 1754”, “Payment terms” refer to the conditions and arrangements governing the payment of invoices. Payment terms specify when and how payments are to be made, including the due date, method of payment, and any applicable discounts or penalties.

Payment terms play a crucial role in determining the cash flow and financial management of businesses. Clear and well-defined payment terms help businesses manage their accounts receivable, forecast cash flow, and avoid late payments. Conversely, ambiguous or unfavorable payment terms can lead to delays in payments, disputes, and strained business relationships.

Real-life examples of payment terms in “difference between invoice and proforma invoice proforma invoice history free professional resume examples 1240 x 1754” include “net 30,” which means the payment is due within 30 days of the invoice date, or “2% discount, net 10,” which offers a 2% discount if the payment is made within 10 days, with the full amount due within 30 days. These terms incentivize timely payments and help businesses optimize their working capital.

Understanding payment terms is essential for businesses to negotiate favorable payment arrangements, avoid late payment penalties, and maintain good relationships with their customers. Businesses should carefully consider their financial situation, industry practices, and customer relationships when setting payment terms for invoices and proforma invoices.

Taxes

Taxes play a significant role in the context of “difference between invoice and proforma invoice proforma invoice history free professional resume examples 1240 x 1754”. Understanding their implications is crucial for businesses to ensure compliance, avoid penalties, and optimize financial planning.

-

Tax calculation

Taxes are calculated based on the type of transaction, the goods or services being sold, and the applicable tax rates. Businesses need to accurately calculate taxes to avoid legal issues and maintain financial integrity.

-

Tax invoices

Tax invoices are invoices that include a breakdown of taxes charged on the goods or services sold. These invoices are crucial for businesses to claim tax credits and deductions.

-

Tax exemptions

Certain goods or services may be exempt from taxes. Businesses should be aware of the tax laws and regulations to identify and apply for tax exemptions where applicable.

-

Tax audits

Tax authorities may conduct audits to verify compliance with tax laws. Businesses should maintain accurate records and documentation to support their tax calculations and avoid penalties.

In conclusion, understanding taxes in the context of “difference between invoice and proforma invoice proforma invoice history free professional resume examples 1240 x 1754” involves considering tax calculation, tax invoices, tax exemptions, and tax audits. By staying informed about tax laws and regulations, businesses can ensure compliance, avoid financial risks, and optimize their tax management strategies.

Legal implications

Understanding the legal implications related to “difference between invoice and proforma invoice proforma invoice history free professional resume examples 1240 x 1754” is crucial for businesses to mitigate risks, ensure compliance, and maintain ethical business practices.

-

Contractual obligations

Invoices and proforma invoices can create legally binding contracts between businesses and their customers. It’s important to ensure that the terms and conditions outlined in these documents are clear, accurate, and compliant with applicable laws.

-

Tax compliance

Businesses are legally obligated to comply with tax regulations and accurately report income and expenses. Invoices and proforma invoices serve as key documentation for tax purposes, and businesses must ensure that they are properly recording and reporting all transactions.

-

Consumer protection laws

Certain consumer protection laws may apply to invoices and proforma invoices, particularly in cases involving misrepresentation, fraud, or deceptive practices. Businesses must ensure that their invoices and proforma invoices are transparent, accurate, and do not mislead customers.

-

Dispute resolution

Invoices and proforma invoices can serve as evidence in the event of disputes between businesses and their customers. Clear and accurate documentation can help businesses resolve disputes efficiently and protect their legal interests.

By understanding and adhering to the legal implications of “difference between invoice and proforma invoice proforma invoice history free professional resume examples 1240 x 1754”, businesses can minimize legal risks, maintain ethical business practices, and foster strong customer relationships built on trust and transparency.

Historical context

Understanding the historical context of “difference between invoice and proforma invoice proforma invoice history free professional resume examples 1240 x 1754” provides valuable insights into the evolution and significance of these documents in business transactions.

Historically, invoices have been used as records of completed sales, serving as legal documentation for accounting and tax purposes. Proforma invoices, on the other hand, emerged as a tool to facilitate international trade, allowing businesses to quote prices and request payments before the delivery of goods or services.

The development of electronic invoicing and proforma invoicing in recent decades has transformed the landscape of business transactions. Electronic invoicing streamlines the billing process, reduces costs, and improves efficiency, while proforma invoices continue to play a crucial role in international trade, particularly in complex transactions involving multiple parties.

By understanding the historical context of “difference between invoice and proforma invoice proforma invoice history free professional resume examples 1240 x 1754,” businesses can appreciate the evolution of these documents and adapt to the changing business environment, ensuring efficient and compliant financial practices.

Modern applications

Within the context of “difference between invoice and proforma invoice proforma invoice history free professional resume examples 1240 x 1754”, “Modern applications” refer to the contemporary uses and adaptations of invoices and proforma invoices in the digital age. These applications leverage technological advancements to streamline billing processes, enhance data management, and optimize financial operations.

-

Electronic invoicing

Electronic invoicing involves the exchange of invoices in digital formats, replacing traditional paper-based methods. It offers numerous benefits, including reduced costs, faster processing times, and improved accuracy.

-

Automated invoice processing

Automated invoice processing utilizes software to streamline the invoice processing cycle. It automates tasks such as data extraction, validation, and approval, increasing efficiency and reducing errors.

-

Cloud-based invoicing platforms

Cloud-based invoicing platforms provide businesses with a centralized, online platform to manage their invoices. These platforms offer features such as invoice creation, tracking, and reporting, accessible from anywhere with an internet connection.

-

Integration with accounting systems

Modern invoicing solutions seamlessly integrate with accounting systems, enabling automatic data transfer and reconciliation. This integration streamlines financial reporting and reduces manual data entry errors.

These modern applications of invoices and proforma invoices empower businesses to streamline their billing processes, improve data accuracy, and gain valuable insights into their financial performance. By embracing these technologies, businesses can enhance their efficiency, reduce costs, and make informed decisions to drive growth and profitability.

Frequently Asked Questions about “Difference Between Invoice and Proforma Invoice, Proforma Invoice History, Free Professional Resume Examples 1240 x 1754”

This FAQ section addresses common queries and provides clarity on various aspects related to invoices, proforma invoices, and their historical context.

Question 1: What is the primary difference between an invoice and a proforma invoice?

An invoice records a completed transaction, while a proforma invoice outlines the terms of a potential transaction.

Question 2: When should a proforma invoice be used?

Proforma invoices are typically used to quote prices, request advance payments, or secure payment before delivering goods or services.

Question 3: What are the legal implications of invoices and proforma invoices?

Invoices serve as legally binding contracts, while proforma invoices may be used as evidence in the event of disputes.

Question 4: How has technology impacted modern invoicing practices?

Electronic invoicing, automated invoice processing, and cloud-based invoicing platforms have streamlined billing processes and improved data management.

Question 5: What are the benefits of using cloud-based invoicing platforms?

Cloud-based invoicing platforms offer centralized access, automated data transfer, and valuable insights into financial performance.

Question 6: Where can I find free professional resume examples in the context of “Difference Between Invoice and Proforma Invoice, Proforma Invoice History, Free Professional Resume Examples 1240 x 1754”?

This article provides links to free professional resume examples that can be tailored to showcase your skills and experience in invoice and proforma invoice management.

In summary, understanding the differences between invoices and proforma invoices, their historical evolution, and modern applications is crucial for businesses to optimize their billing processes, ensure compliance, and make informed financial decisions.

The next section will delve deeper into best practices for creating and managing invoices and proforma invoices to maximize their effectiveness and minimize errors.

Tips for Managing Invoices and Proforma Invoices

This section provides practical tips to help businesses create and manage invoices and proforma invoices effectively, ensuring accuracy, compliance, and efficient billing processes.

Tip 1: Use clear and consistent templates: Establish standardized invoice and proforma invoice templates that include all necessary information, such as company details, invoice number, payment terms, and tax calculations.

Tip 2: Verify customer information: Double-check customer contact information, including name, address, and email, to ensure accurate delivery and communication.

Tip 3: Describe products or services precisely: Provide clear descriptions of the goods or services being invoiced, including quantities, unit prices, and any applicable discounts or surcharges.

Tip 4: Calculate taxes accurately: Comply with tax regulations by calculating and including the correct tax amounts on invoices. Stay updated on tax laws and consult with tax professionals if needed.

Tip 5: Set clear payment terms: Specify the payment due date, accepted payment methods, and any early payment discounts or late payment penalties to avoid confusion and ensure timely payments.

Tip 6: Use electronic invoicing systems: Consider implementing electronic invoicing solutions to streamline billing processes, reduce costs, and improve efficiency.

Tip 7: Keep accurate records: Maintain organized records of all invoices and proforma invoices issued, including copies of supporting documentation for audit purposes.

Tip 8: Seek professional advice: Consult with accountants or legal professionals for guidance on complex invoicing issues, such as tax implications or contractual obligations.

By following these tips, businesses can optimize their invoice and proforma invoice management practices, ensuring accuracy, compliance, and efficient billing processes. This lays the foundation for strong financial management and customer relationships.

The concluding section of this article will explore strategies for resolving invoice disputes and maintaining

Conclusion

This comprehensive exploration of “difference between invoice and proforma invoice, proforma invoice history, free professional resume examples 1240 x 1754” has illuminated the distinct roles and applications of these documents in business transactions. Key insights include the legal implications of invoices, the importance of clear payment terms, and the benefits of modern invoicing practices.

Understanding these differences and best practices empowers businesses to optimize their billing processes, maintain compliance, and build strong customer relationships. By embracing electronic invoicing, leveraging cloud-based platforms, and seeking professional advice when needed, businesses can streamline their operations, reduce costs, and gain valuable financial insights.