A consultant invoice template in Word, a noun, is a pre-designed document formatted specifically for consultants to create and submit invoices for their services. For instance, a business consultant may use an invoice template to bill clients for project-related expenses, hours worked, and deliverables.

Using a consultant invoice template offers several benefits, including time savings, accuracy, and standardization. Historically, consultants would manually create invoices, which could be time-consuming and prone to errors. However, pre-designed templates streamline the invoicing process, ensuring consistency and accuracy.

This article delves into the essential components of a consultant invoice template in Word, providing guidance on its use and customization. It will also discuss best practices for invoicing, ensuring clear and timely communication with clients.

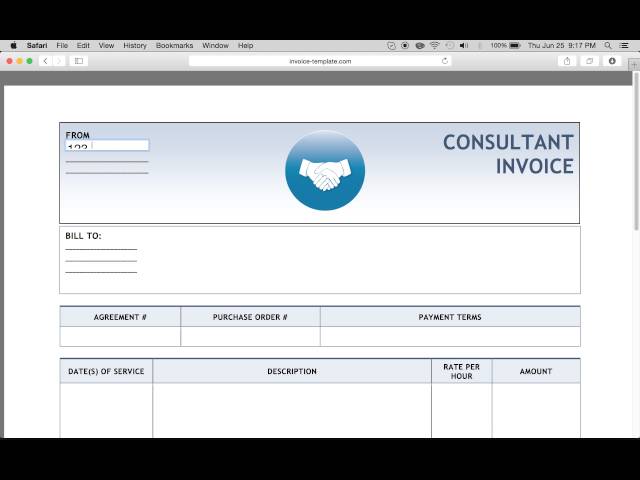

consultant invoice template word

The essential aspects of a consultant invoice template in Word are crucial for creating clear, accurate, and professional invoices. These aspects ensure that consultants can effectively communicate the details of their services and billing to clients.

- Company Information

- Client Information

- Invoice Number

- Invoice Date

- Due Date

- Description of Services

- Quantity

- Rate

- Amount

- Payment Terms

By including these essential aspects in their invoice templates, consultants can ensure that their invoices are complete, accurate, and compliant with industry standards. This not only streamlines the invoicing process but also helps to maintain positive relationships with clients by providing clear and timely communication.

Company Information

Company Information is a critical component of a Consultant Invoice Template in Word. It establishes the identity of the consultant or consulting firm and provides essential contact details for the client. The company name, address, phone number, email address, and website (if applicable) should be clearly displayed on the invoice. This information serves several important purposes:

Firstly, it ensures that the client can easily identify the sender of the invoice and contact them if they have any questions or need to discuss payment. Secondly, it helps to establish the credibility and professionalism of the consultant or consulting firm. A well-presented invoice with complete company information conveys a sense of organization and attention to detail. Thirdly, it helps to build trust between the consultant and the client by providing a clear and transparent record of the services provided and the amount due.

In practice, Company Information is typically included in the header or footer of a Consultant Invoice Template in Word. It is important to ensure that the font and size of the text are consistent with the rest of the invoice and that the information is easy to read and understand. By including complete and accurate Company Information on their invoices, consultants can enhance their professional image, streamline communication with clients, and foster long-lasting business relationships.

Client Information

In a Consultant Invoice Template in Word, the Client Information section is a crucial element that establishes the identity of the individual or organization receiving the invoice. It includes essential details such as the client’s name, address, phone number, email address, and (optionally) their tax identification number. This information serves multiple purposes:

- Accurate Billing: Complete and accurate Client Information ensures that the invoice is addressed to the correct recipient and that the payment is directed to the appropriate account. It eliminates errors and confusion, ensuring timely and efficient payment processing.

- Legal Compliance: In many jurisdictions, invoices must include specific client details for legal and tax compliance purposes. Providing accurate Client Information helps consultants meet these requirements and avoid potential legal issues.

- Professionalism: A well-organized invoice with complete Client Information conveys a sense of professionalism and attention to detail. It demonstrates that the consultant values their client relationship and takes pride in providing clear and accurate documentation.

In practice, the Client Information section is typically placed at the top of a Consultant Invoice Template in Word, following the consultant’s Company Information. The font and size of the text should be consistent with the rest of the invoice, and the information should be easy to read and understand. By including complete and accurate Client Information on their invoices, consultants can streamline the billing process, enhance their professional image, and foster trust with their clients.

Invoice Number

The Invoice Number is a critical component of a Consultant Invoice Template in Word, serving as a unique identifier for each invoice issued. It plays a pivotal role in the invoicing process, offering several key benefits:

- Unique Identification: Each Invoice Number is distinct, allowing consultants to easily track and manage multiple invoices. It helps prevent confusion and ensures that each invoice is processed accurately.

- Simplified Record-Keeping: Assigning unique Invoice Numbers enables consultants to maintain organized records for accounting and tax purposes. It simplifies the retrieval of specific invoices when needed.

- Legal Compliance: In many jurisdictions, invoices must include unique identifiers for legal compliance and audit purposes. The Invoice Number helps consultants meet these requirements.

In practice, the Invoice Number is typically displayed prominently on a Consultant Invoice Template in Word, often in the header or footer. It should be clearly visible and easy to identify. Consultants may choose to use a sequential numbering system or incorporate a prefix or suffix to further enhance uniqueness.

Understanding the connection between Invoice Number and Consultant Invoice Template in Word is crucial for effective invoice management. By utilizing unique Invoice Numbers, consultants can streamline their invoicing processes, maintain accurate records, and ensure compliance with legal requirements. This understanding empowers them to manage their finances efficiently and maintain strong relationships with their clients.

Invoice Date

Within the context of a Consultant Invoice Template in Word, the Invoice Date holds significant importance. It serves as a crucial reference point for both the consultant and the client, establishing the timing of the invoice and its associated payment terms. Exploring the various aspects of the Invoice Date provides a deeper understanding of its role in the invoicing process.

-

Date of Issuance

The Invoice Date indicates the specific day when the invoice is created and issued to the client. It acts as a timestamp, capturing the moment when the consultant formally requests payment for services rendered.

-

Start of Payment Period

For many invoices, the Invoice Date also marks the commencement of the payment period. Clients typically have a set number of days (e.g., 30 or 60 days) from the Invoice Date to settle their payment.

-

Legal Implications

The Invoice Date may have legal implications, particularly in cases of disputes or late payments. It serves as a reference point for calculating interest or penalties, as well as determining the timeliness of payments.

-

Tax Considerations

In some jurisdictions, the Invoice Date plays a role in determining the applicable tax rates and regulations. It helps ensure compliance with tax laws and accurate reporting of income and expenses.

Understanding the multifaceted aspects of the Invoice Date empowers consultants to create clear and accurate invoices that facilitate timely payments. By adhering to best practices and considering the implications outlined above, consultants can optimize their invoicing processes and maintain strong relationships with their clients.

Due Date

Within the context of a Consultant Invoice Template in Word, the Due Date holds immense significance. It establishes the timeframe for payment and serves as a critical reference point for both consultants and clients. This exploration will delve into various facets of the Due Date, examining its components, implications, and best practices.

-

Payment Timeline

The Due Date defines the specific date by which payment is expected from the client. Consultants typically specify this date based on their payment terms, industry norms, and contractual agreements.

-

Late Payment Implications

The Due Date helps determine the consequences of late payments. Consultants may charge interest or late fees if clients fail to settle their invoices by the specified date.

-

Legal Considerations

In some jurisdictions, the Due Date may have legal implications. It can influence the validity of the invoice and serve as a reference point for resolving disputes.

-

Client Relationships

Establishing clear Due Dates fosters transparency and accountability in the consultant-client relationship. It helps avoid misunderstandings and ensures timely payments.

Understanding the Due Date and its various facets empowers consultants to create effective and legally compliant invoices. By setting appropriate Due Dates and communicating them clearly to clients, consultants can streamline their payment processes, minimize late payments, and maintain strong business relationships.

Description of Services

Within the realm of consultant invoice templates in Word, the Description of Services section assumes critical importance. It serves as the foundation upon which accurate and comprehensive invoices are built, enabling consultants to clearly outline the nature and scope of services provided to their clients. This section plays a pivotal role in ensuring transparency, accuracy, and effective communication between consultants and clients.

The Description of Services acts as a detailed record of the specific tasks, deliverables, or outcomes achieved by the consultant. It provides a comprehensive overview of the value delivered, allowing clients to easily understand the services they have received. Moreover, it forms the basis for calculating the fees charged, ensuring that consultants are fairly compensated for their expertise and efforts.

Real-life examples of Description of Services may include detailed descriptions of consulting services such as project management, strategic planning, market research, or financial analysis. Consultants may also provide a breakdown of services into smaller tasks or milestones, offering clients a granular understanding of the work performed. By providing clear and concise descriptions, consultants can minimize misunderstandings and disputes, fostering a strong foundation for successful client relationships.

Understanding the practical applications of the Description of Services is crucial for both consultants and clients. For consultants, it ensures accurate invoicing and effective communication of the value they provide. For clients, it offers transparency into the services received, enabling them to make informed decisions about payment and future engagements. By leveraging this understanding, consultants can enhance their professionalism, streamline their billing processes, and cultivate lasting client relationships.

Quantity

Within the context of consultant invoice templates in Word, the “Quantity” field holds significant importance as it directly relates to the calculation of fees charged for services rendered. It represents the numerical value associated with specific tasks, deliverables, or units of service provided to clients.

The “Quantity” field is a critical component of consultant invoice templates because it enables accurate billing practices. By specifying the quantity of services provided, consultants can precisely determine the total amount due from their clients. This ensures fairness and transparency in the invoicing process, as clients can easily verify the services they have received and the corresponding charges.

Real-life examples of “Quantity” in consultant invoice templates may include:

- Number of hours spent on consulting services

- Quantity of deliverables produced, such as reports, presentations, or software code

- Number of units of service provided, such as training sessions or project milestones

Understanding the practical applications of “Quantity” in consultant invoice templates is crucial for both consultants and clients. For consultants, it ensures accurate invoicing and effective communication of the value they provide. For clients, it offers transparency into the services received, enabling them to make informed decisions about payment and future engagements. By leveraging this understanding, consultants can enhance their professionalism, streamline their billing processes, and cultivate lasting client relationships.

Rate

Within the context of consultant invoice templates in Word, the “Rate” field holds significant importance as it directly influences the calculation of fees charged for services rendered. It represents the monetary value assigned to each unit of service, task, or deliverable provided to clients.

The “Rate” field is a critical component of consultant invoice templates because it enables accurate and competitive pricing. By specifying the rate, consultants can determine the total amount due from their clients based on the quantity of services provided. This ensures transparency and fairness in the invoicing process, as clients can easily verify the charges and compare them against industry benchmarks or previous agreements.

Real-life examples of “Rate” in consultant invoice templates may include:

- Hourly rate for consulting services

- Per-unit rate for deliverables such as reports or software code

- Fixed rate for project milestones or specific outcomes

Understanding the practical applications of “Rate” in consultant invoice templates is crucial for both consultants and clients. For consultants, it ensures accurate invoicing, competitive pricing, and effective communication of the value they provide. For clients, it offers transparency into the costs of services, enabling them to make informed decisions about payment and future engagements. By leveraging this understanding, consultants can enhance their professionalism, streamline their billing processes, and cultivate lasting client relationships.

Amount

In the context of consultant invoice templates in Word, the “Amount” field holds paramount importance as it represents the monetary value of services rendered or goods delivered to a client. Accurately calculating and presenting the “Amount” is crucial for both consultants and clients, as it forms the basis for payment and subsequent financial transactions.

-

Total Amount

The total amount due, calculated by multiplying the “Quantity” by the “Rate” for each service or item listed on the invoice.

-

Itemized Amounts

A breakdown of the total amount, showing the specific charges for each individual service or item provided.

-

Taxes and Fees

Additional charges such as sales tax, value-added tax, or other applicable fees, which may be calculated as a percentage of the total amount or listed separately.

-

Discounts and Adjustments

Any discounts or adjustments applied to the total amount, such as early payment discounts or volume discounts.

Understanding the various facets and implications of “Amount” in consultant invoice templates in Word is essential for accurate invoicing and transparent financial communication. By carefully calculating and presenting the “Amount” field, consultants can ensure that clients have a clear understanding of the charges and can make informed payment decisions. Moreover, proper handling of the “Amount” field contributes to efficient bookkeeping and simplifies the reconciliation process for both parties involved.

Payment Terms

In the realm of consultant invoice templates in Word, “Payment Terms” hold immense significance as they establish the guidelines and expectations for payment between consultants and clients. These terms outline the methods, timelines, and any additional conditions related to the settlement of invoices.

“Payment Terms” serve as a critical component of consultant invoice templates in Word as they ensure timely and efficient payment processing. By setting clear expectations upfront, both parties can avoid misunderstandings, late payments, and potential financial disputes. Consultants can tailor the “Payment Terms” section to suit their specific business needs and industry norms.

Real-life examples of “Payment Terms” within consultant invoice templates in Word may include:

- Due Date: The specific date by which payment is expected from the client.

- Payment Methods: The acceptable methods of payment, such as bank transfer, credit card, or check.

- Early Payment Discounts: Incentives offered to clients who pay within a shorter timeframe.

- Late Payment Fees: Penalties or interest charges applied if payment is not received by the due date.

Understanding the practical applications of “Payment Terms” in consultant invoice templates in Word is invaluable for both consultants and clients. For consultants, it helps streamline invoicing and payment processes, reduces the risk of late payments, and fosters positive client relationships. For clients, clear “Payment Terms” provide transparency and predictability regarding their financial obligations. By leveraging this understanding, consultants can enhance the overall efficiency and professionalism of their invoicing practices.

FAQs on Consultant Invoice Template Word

This FAQ section aims to address common queries and clarify aspects related to consultant invoice templates in Word. Here, we provide answers to six frequently asked questions to further enhance your understanding and enable you to create effective and professional invoices.

Question 1: What is a consultant invoice template in Word?

A consultant invoice template in Word is a pre-designed document that provides a structured format for consultants to create and submit invoices for their services. It includes essential fields such as company information, client information, description of services, and payment terms, streamlining the invoicing process and ensuring consistency.

Question 2: Why should I use a consultant invoice template in Word?

Using a consultant invoice template in Word offers several benefits. It saves time by providing a ready-made framework, reduces errors by ensuring all necessary information is included, enhances professionalism by presenting a polished and organized invoice, and facilitates record-keeping by maintaining a standardized format.

Question 3: What are the key elements of a consultant invoice template in Word?

The key elements of a consultant invoice template in Word typically include the consultant’s company information, client information, invoice number, invoice date, due date, description of services, quantity, rate, amount, payment terms, and any applicable taxes or discounts.

Question 4: How do I customize a consultant invoice template in Word?

You can customize a consultant invoice template in Word by adding your company logo, modifying the color scheme and fonts, adjusting the layout to suit your preferences, and including any additional sections or fields specific to your business.

Question 5: Can I use a consultant invoice template in Word for international clients?

Yes, you can use a consultant invoice template in Word for international clients. However, be sure to consider any specific requirements or regulations related to invoicing in different countries, such as varying tax rates or legal language.

Question 6: What are some tips for creating effective consultant invoices in Word?

To create effective consultant invoices in Word, ensure accuracy in all fields, provide clear descriptions of services rendered, specify payment terms and due dates prominently, follow a consistent and professional design, and consider using invoicing software to streamline the process and manage your invoices efficiently.

These FAQs provide insights into essential aspects of consultant invoice templates in Word, empowering you to create professional and informative invoices that effectively communicate the value of your services to clients.

In the next section, we will delve deeper into best practices for using consultant invoice templates in Word, exploring advanced features and techniques to enhance the efficiency and effectiveness of your invoicing processes.

Tips for Using Consultant Invoice Templates in Word

This section provides actionable tips to help you effectively utilize consultant invoice templates in Word, ensuring your invoices are accurate, professional, and efficient.

Tip 1: Customize Your Template

Tailor the template to reflect your company’s branding and specific invoicing requirements.

Tip 2: Use Clear and Concise Language

Ensure your invoice is easy to read and understand, avoiding jargon or technical terms.

Tip 3: Include Detailed Descriptions

Provide specific details about the services rendered, including the scope of work, deliverables, and any additional expenses.

Tip 4: Set Clear Payment Terms

State your payment terms prominently, including the due date, acceptable payment methods, and any applicable late payment fees.

Tip 5: Proofread Carefully

Thoroughly review your invoice for any errors in information, calculations, or formatting before sending it to the client.

Tip 6: Use Invoicing Software

Consider using invoicing software to automate the invoicing process, track payments, and generate reports.

Tip 7: Seek Professional Advice

If you have complex invoicing requirements or need assistance customizing your template, consult with a professional accountant or lawyer.

Following these tips can enhance the effectiveness of your consultant invoice templates in Word, ensuring accuracy, clarity, and efficiency in your invoicing practices.

In the concluding section, we will explore advanced strategies for maximizing the benefits of consultant invoice templates in Word, further optimizing your invoicing processes and elevating your professional image.

Conclusion

Throughout this exploration, we have delved into the intricacies of consultant invoice templates in Word, uncovering their significance and providing practical guidance for their effective utilization. Key insights include the importance of customization, clear communication, accurate documentation, and the benefits of leveraging technology.

By adhering to best practices and embracing advanced strategies, consultants can optimize their invoicing processes, enhance the professionalism of their invoices, and foster stronger client relationships. Remember, a well-crafted invoice not only serves as a financial document but also reflects the value and credibility of your consulting services.