Accounts Payable Automation: Streamlining Invoice Processing and Reconciliation

Accounts payable (AP) automation is a comprehensive solution that automates the end-to-end AP process, including invoice receipt, data capture, workflow approval, electronic invoice reconciliation, and payment execution. In a traditional AP setup, the reconciliation process involves manually matching invoices to purchase orders and receiving reports, which can be a time-consuming and error-prone task. AP automation eliminates this challenge by leveraging technology to streamline the entire process.

The benefits of AP automation are numerous and include reduced costs, improved efficiency, enhanced accuracy, increased control, and better supplier relationships. One of the key historical developments in AP automation was the introduction of electronic invoice reconciliation (EIR) in the early 2000s. EIR automates the matching of invoices to purchase orders and receiving reports, eliminating the need for manual intervention and reducing errors.

This article will delve into the details of AP automation, discussing its components, benefits, implementation challenges, and best practices. By embracing AP automation, businesses can significantly improve their invoice processing and reconciliation operations, leading to greater efficiency, cost savings, and control.

AP Automation

AP automation encompasses various key aspects that contribute to its effectiveness in streamlining invoice processing and reconciliation. Here are 10 essential aspects to consider:

- Data accuracy: Accurate data capture and validation ensures error-free processing.

- Workflow automation: Automated approval routing eliminates manual intervention and delays.

- Electronic invoice reconciliation: Automates invoice matching to purchase orders and receiving reports.

- Exception handling: Automated identification and handling of invoice discrepancies.

- Supplier management: Centralized supplier data and self-service portals improve collaboration.

- Payment processing: Automated payment execution reduces errors and improves efficiency.

- Reporting and analytics: Real-time insights into AP performance and supplier metrics.

- Integration: Seamless integration with ERP and other financial systems.

- Cloud-based: Accessibility and scalability without the need for on-premise infrastructure.

- Security: Encryption and compliance measures protect sensitive financial data.

These aspects work together to optimize the AP process. For instance, data accuracy ensures that invoices are matched correctly during electronic invoice reconciliation, reducing exceptions and improving payment accuracy. Automated workflow approval eliminates bottlenecks and delays, ensuring timely invoice processing. Supplier management improves collaboration and reduces the risk of duplicate payments. Reporting and analytics provide valuable insights into AP performance, enabling businesses to identify areas for improvement.

Data accuracy

In the context of AP automation, data accuracy serves as the foundation for efficient and error-free invoice processing and reconciliation. Accurate data capture and validation eliminate manual errors and ensure that invoices are processed correctly, leading to timely payments, reduced exceptions, and improved overall AP performance.

AP automation solutions leverage data capture technologies such as optical character recognition (OCR) and artificial intelligence (AI) to extract invoice data automatically. These technologies ensure high levels of accuracy and reduce the risk of human errors that can occur during manual data entry. By capturing data directly from invoices, AP automation eliminates the need for rekeying and minimizes the potential for errors.

Accurate data is crucial for effective electronic invoice reconciliation. During reconciliation, AP automation systems match invoice data against purchase orders and receiving reports to identify discrepancies. Accurate data ensures that invoices are matched correctly, reducing the risk of duplicate payments, overpayments, or missed payments. It also enables automated exception handling, allowing businesses to quickly identify and resolve any discrepancies, streamlining the reconciliation process and reducing the workload for accounts payable teams.

In summary, data accuracy is a critical component of AP automation, as it ensures error-free processing and efficient electronic invoice reconciliation. By eliminating manual data entry and leveraging technology to capture and validate invoice data, AP automation reduces the risk of errors, improves efficiency, and enhances the overall accuracy and reliability of the AP process.

Workflow automation

Workflow automation is a central aspect of AP automation, enabling the elimination of manual intervention and delays in the invoice approval process. It involves the use of software to automate the routing of invoices for approval based on predefined rules and criteria, ensuring timely and efficient processing.

- Automated routing: Invoices are automatically routed to the appropriate approvers based on criteria such as invoice amount, vendor, or department, eliminating the need for manual distribution and tracking.

- Approval notifications: Approvers receive automated notifications when invoices are assigned to them, ensuring timely attention and reducing the risk of missed approvals.

- Approval tracking: The system tracks the status of each invoice throughout the approval process, providing real-time visibility and eliminating the need for manual follow-ups.

- Exception handling: Automated workflows can be configured to handle exceptions, such as invoices requiring special approvals or additional documentation, ensuring that these invoices are processed efficiently without delays.

By automating the invoice approval process, AP automation streamlines the entire AP workflow, eliminating bottlenecks and reducing the time it takes to process and pay invoices. This leads to improved efficiency, reduced costs, and enhanced control over the AP process. Moreover, it frees up accounts payable staff from manual tasks, allowing them to focus on more strategic and value-added activities.

Electronic invoice reconciliation

Electronic invoice reconciliation is a core component of AP automation, enabling businesses to streamline and automate the matching of invoices to purchase orders and receiving reports. This process involves comparing data from these documents to identify discrepancies and ensure accurate payment. Here are some key facets of electronic invoice reconciliation:

- Data extraction: Electronic invoice reconciliation systems use OCR and AI technologies to extract data from invoices and other documents, eliminating the need for manual data entry and reducing the risk of errors.

- Matching algorithms: Sophisticated matching algorithms are used to compare data from invoices, purchase orders, and receiving reports, identifying matches and exceptions based on criteria such as invoice number, amount, and line items.

- Exception handling: The system automatically identifies and flags exceptions, such as mismatched quantities or prices, allowing accounts payable teams to quickly investigate and resolve these discrepancies.

- Approval workflow: Electronic invoice reconciliation systems can be integrated with workflow automation tools, allowing approvers to review and approve invoices electronically, streamlining the approval process and reducing delays.

Electronic invoice reconciliation offers numerous benefits, including reduced processing time, improved accuracy, and enhanced control over the AP process. By automating the matching of invoices to purchase orders and receiving reports, businesses can eliminate manual errors, reduce the risk of duplicate payments, and improve supplier relationships. Moreover, it enables better cash flow management and fraud prevention, contributing to overall financial efficiency and compliance.

Exception handling

Exception handling is a critical aspect of AP automation, enabling the identification and management of invoice discrepancies. By automating this process, businesses can streamline their AP workflow, reduce manual intervention, and improve the accuracy and efficiency of invoice processing.

- Invoice validation: Automated systems validate invoices against predefined rules and criteria, identifying discrepancies such as missing or invalid data, incorrect calculations, or duplicate invoices.

- Threshold-based routing: Invoices with discrepancies can be automatically routed to specific approvers or queues based on predefined thresholds, ensuring that exceptions are handled by the appropriate personnel.

- Automated notifications: Approvers are notified of exceptions via email or other communication channels, ensuring timely attention and preventing delays in invoice processing.

- Exception resolution workflow: Automated workflows guide approvers through the exception resolution process, providing clear instructions and facilitating collaboration between different stakeholders.

Automated exception handling streamlines the AP process by eliminating manual intervention and reducing the risk of errors. It ensures that discrepancies are identified and resolved quickly, preventing delays in invoice processing and payment. Moreover, it provides a centralized platform for managing exceptions, improving visibility and control over the entire AP workflow.

Supplier management

Within the realm of “ap automation ipayables accounts payable automation electronic invoice reconciliation process”, supplier management plays a crucial role in streamlining collaboration and enhancing the overall efficiency of the AP process. Centralized supplier data and self-service portals are two key aspects of supplier management that contribute significantly to these improvements.

-

Centralized supplier data:

A centralized supplier database serves as a single repository for all supplier information, including contact details, payment terms, and purchase history. This eliminates the need for multiple spreadsheets or disparate systems, ensuring data accuracy and consistency.

-

Self-service portals:

Self-service portals provide suppliers with secure access to their own data, allowing them to view invoices, track payments, and update their information. This enhances transparency and reduces the need for manual inquiries, streamlining communication and fostering better supplier relationships.

The combination of centralized supplier data and self-service portals empowers both businesses and suppliers. Businesses gain improved visibility into their supplier network, enabling better decision-making and risk management. Suppliers, on the other hand, benefit from easy access to information and the ability to manage their accounts efficiently, reducing the administrative burden and fostering collaboration.

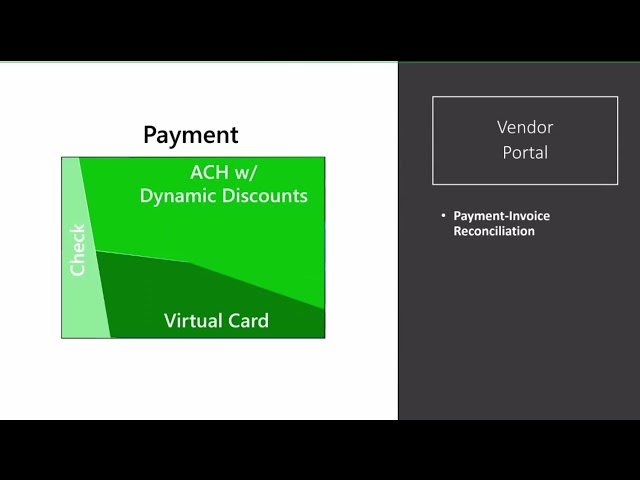

Payment processing

As an integral part of AP automation, payment processing plays a critical role in streamlining financial operations. Automated payment execution, specifically, brings significant advantages by minimizing errors and enhancing efficiency.

- Reduced manual intervention: Automation eliminates manual tasks such as check printing, mailing, and data entry, reducing the risk of human errors and saving time.

- Improved accuracy: Automated systems ensure that payments are processed according to predefined rules and that payment details are accurate, minimizing errors and reducing the risk of duplicate payments or overpayments.

- Streamlined reconciliation: Automated payment execution facilitates reconciliation by providing a clear audit trail and reducing the need for manual matching of payments to invoices, saving time and effort.

- Enhanced supplier relationships: Timely and accurate payments foster positive supplier relationships, reducing the likelihood of disputes and improving overall collaboration.

By automating payment processing, businesses can streamline their AP workflow, improve accuracy and efficiency, and strengthen their supplier relationships. This contributes to better financial management, reduced costs, and improved overall operational performance.

Reporting and analytics

Reporting and analytics play a crucial role within the “ap automation ipayables accounts payable automation electronic invoice reconciliation process” by providing real-time insights into AP performance and supplier metrics. These insights enable businesses to identify areas for improvement, optimize processes, and make informed decisions to enhance their AP operations.

The data gathered from AP automation systems, such as invoice processing times, payment trends, and supplier performance metrics, empowers businesses to gain a comprehensive understanding of their AP processes. This information can be used to identify bottlenecks, reduce inefficiencies, and improve overall AP efficiency. By analyzing supplier metrics, businesses can assess supplier performance, identify potential risks, and optimize supplier relationships.

For instance, a business may use AP automation reporting to identify that a particular invoice approval process is causing delays. Armed with this insight, the business can investigate the underlying cause, such as missing approvers or complex approval workflows, and take steps to streamline the process, resulting in faster invoice processing and improved supplier relationships. Real-time insights into AP performance also enable businesses to make proactive decisions, such as adjusting payment terms or negotiating discounts with suppliers based on their performance metrics.

In summary, reporting and analytics are a critical component of “ap automation ipayables accounts payable automation electronic invoice reconciliation process”, providing valuable insights that help businesses optimize their AP operations, improve supplier relationships, and make informed decisions to drive financial performance. By leveraging these insights, businesses can gain a competitive edge and achieve greater efficiency and cost savings in their AP processes.

Integration

Within the realm of “ap automation ipayables accounts payable automation electronic invoice reconciliation process,” seamless integration with ERP (Enterprise Resource Planning) and other financial systems plays a pivotal role in streamlining operations and enhancing efficiency. By integrating with ERP systems, AP automation can automate data transfer between different modules, eliminating the need for manual data entry and reducing the risk of errors. This integration enables real-time data sharing, ensuring that all departments have access to the most up-to-date information.

- Data synchronization: AP automation integrates with ERP systems to synchronize data such as vendor master data, chart of accounts, and cost centers, ensuring that all systems are working with the same set of information. This eliminates the risk of errors caused by manual data entry and ensures that all departments have a consistent view of the data.

- Automated transaction posting: Once invoices are approved in the AP automation system, they can be automatically posted to the ERP system, eliminating the need for manual journal entries. This streamlines the accounting process and reduces the risk of errors.

- Real-time reporting: The integration between AP automation and ERP systems enables real-time reporting, providing businesses with up-to-date insights into their financial performance. This information can be used to make informed decisions and identify areas for improvement.

- Improved collaboration: Seamless integration fosters collaboration between different departments, such as AP, procurement, and finance, by providing a centralized platform for managing invoice processing and payments. This eliminates communication barriers and ensures that all stakeholders have access to the same information.

In summary, the seamless integration of AP automation with ERP and other financial systems is crucial for streamlining operations, reducing errors, and enhancing efficiency. By automating data transfer, eliminating manual processes, and providing real-time insights, businesses can optimize their AP processes and gain a competitive edge in today’s fast-paced business environment.

Cloud-based

The adoption of cloud-based solutions has revolutionized the “ap automation ipayables accounts payable automation electronic invoice reconciliation process” by eliminating the need for on-premise infrastructure. Cloud-based AP automation solutions are hosted on remote servers, providing businesses with accessibility and scalability on demand. This eliminates the need for businesses to invest in and maintain their own servers, reducing hardware and IT costs.

The scalability of cloud-based AP automation allows businesses to easily adjust their infrastructure to meet changing business needs. During periods of high invoice volume, businesses can scale up their infrastructure to handle the increased workload, and during slower periods, they can scale down to reduce costs. This flexibility ensures that businesses only pay for the resources they need, optimizing their IT spending.

Real-life examples of cloud-based AP automation include platforms such as SAP Ariba, Oracle NetSuite, and Coupa. These solutions offer a comprehensive suite of AP automation capabilities, including invoice receipt, data capture, workflow approval, electronic invoice reconciliation, and payment processing. By leveraging the cloud, these solutions provide businesses with the accessibility and scalability they need to streamline their AP processes and improve efficiency.

The practical applications of cloud-based AP automation are extensive. Businesses can reduce their AP processing time by automating manual tasks, leading to faster invoice processing and improved supplier relationships. Cloud-based AP automation also enhances data security by centralizing data in a secure cloud environment, reducing the risk of data breaches. Furthermore, businesses gain real-time visibility into their AP processes, enabling them to make informed decisions and identify areas for further optimization.

Security

Within the realm of “ap automation ipayables accounts payable automation electronic invoice reconciliation process,” security plays a pivotal role in safeguarding sensitive financial data. Encryption and compliance measures are crucial components that ensure the protection of confidential information throughout the AP process.

- Encryption: Encryption algorithms, such as SSL and TLS, are employed to protect data in transit and at rest, ensuring that unauthorized individuals cannot access sensitive information.

- Data Access Controls: Granular access controls restrict who can view and modify financial data, preventing unauthorized access and potential fraud.

- Compliance with Regulations: AP automation systems adhere to industry regulations and standards, such as PCI DSS and GDPR, ensuring compliance with data protection laws.

- Audit Trails and Logging: Detailed audit trails and logging mechanisms track all activities within the AP automation system, providing a comprehensive record for security and compliance purposes.

By implementing robust security measures, businesses can safeguard their sensitive financial data from unauthorized access, data breaches, and other security threats. Encryption and compliance measures are essential components of AP automation, enabling businesses to automate their AP processes with confidence, knowing that their data is protected.

Frequently Asked Questions on AP Automation

This FAQ section addresses common questions and concerns regarding “ap automation ipayables accounts payable automation electronic invoice reconciliation process” to provide clarity and facilitate understanding.

Question 1: What are the key benefits of implementing AP automation?

Answer: AP automation offers numerous advantages, including reduced costs, improved efficiency, enhanced accuracy, increased control, and better supplier relationships.

Question 2: How does electronic invoice reconciliation streamline the AP process?

Answer: Electronic invoice reconciliation automates the matching of invoices to purchase orders and receiving reports, reducing manual intervention, errors, and processing time.

Question 3: What is the role of data accuracy in AP automation?

Answer: Accurate data capture and validation are crucial for efficient AP automation, ensuring error-free processing, effective invoice reconciliation, and improved overall AP performance.

Question 4: How does AP automation improve supplier relationships?

Answer: By automating invoice processing and payments, AP automation reduces delays and errors, fostering better communication and collaboration with suppliers, leading to stronger relationships.

Question 5: Is AP automation suitable for businesses of all sizes?

Answer: AP automation solutions are scalable and offer benefits for businesses of all sizes, from small startups to large enterprises, by streamlining processes and reducing costs.

Question 6: What are the security considerations for AP automation?

Answer: AP automation systems employ encryption and compliance measures to protect sensitive financial data, ensuring data security and adherence to industry regulations.

In summary, AP automation offers significant benefits in terms of efficiency, accuracy, and control, making it a valuable solution for businesses looking to streamline their AP processes. However, it is crucial to carefully evaluate the specific needs and requirements of your organization before implementing an AP automation solution.

The next section will delve deeper into the implementation considerations for AP automation, providing guidance on successful deployment and maximizing its benefits.

AP Automation Implementation Tips

This section provides a comprehensive set of tips to help you successfully implement and maximize the benefits of AP automation.

Tip 1: Conduct a thorough assessment of your current AP process. Identify areas for improvement, including bottlenecks, inefficiencies, and error-prone tasks.

This will help you: Determine the specific needs and requirements for your AP automation solution.

Tip 2: Choose an AP automation solution that aligns with your business needs. Consider factors such as the size of your organization, industry, and invoice volume.

This will help you: Ensure that you implement a solution that effectively addresses your pain points and provides the desired benefits.

Tip 3: Implement a data migration strategy to ensure accurate data transfer. Plan for the seamless transfer of your existing AP data into the new automation system.

This will help you: Minimize disruptions during the implementation process and maintain the integrity of your financial data.

Tip 4: Train your team on the new AP automation system. Provide comprehensive training to ensure that your staff is proficient in using the system and understands best practices.

This will help you: Maximize user adoption, minimize errors, and drive successful implementation.

Tip 5: Monitor and evaluate the performance of your AP automation system. Track key metrics such as processing time, accuracy, and cost savings to identify areas for further improvement.

This will help you: Continuously optimize your AP automation process and achieve ongoing benefits.

By following these tips, you can effectively implement and maximize the benefits of AP automation. This will help you streamline your AP processes, reduce costs, improve efficiency, and enhance control.

The next section will provide insights into the future of AP automation, exploring emerging trends and innovations that are shaping the industry.

Conclusion

In conclusion, “ap automation ipayables accounts payable automation electronic invoice reconciliation process” offers significant advantages for businesses, streamlining invoice processing, enhancing accuracy, and improving control over AP operations. Key takeaways from this article include the importance of data accuracy for efficient electronic invoice reconciliation, the benefits of automated workflow approval in reducing delays and bottlenecks, and the role of exception handling in identifying and resolving invoice discrepancies. These components work together to optimize the AP process, providing businesses with a competitive edge and enabling them to focus on more strategic initiatives.

As technology continues to advance, the future of AP automation holds exciting possibilities. Integration with artificial intelligence (AI) and machine learning (ML) technologies promises even greater automation and efficiency, enabling businesses to automate complex tasks such as invoice data extraction and fraud detection. Furthermore, the adoption of blockchain technology has the potential to enhance security and transparency in the AP process. By embracing these emerging trends, businesses can position themselves for continued success in the digital age.