A general contractor invoice template is a document used by general contractors to bill clients for services rendered. It typically includes information such as the contractor’s name and contact information, the client’s name and contact information, the date of the invoice, a description of the services performed, the quantity of services performed, the unit price of the services, the total amount due, and any payment terms.

General contractor invoice templates are important because they help contractors to track their income and expenses, and to ensure that they are paid for the work they have done. They can also help contractors to improve their cash flow by providing clients with a clear and concise statement of the services that have been performed and the amount that is due.

One of the most important developments in the history of general contractor invoice templates is the advent of electronic invoicing. Electronic invoicing allows contractors to send invoices to clients electronically, which can save time and money. Electronic invoices can also be more easily tracked and managed than paper invoices.

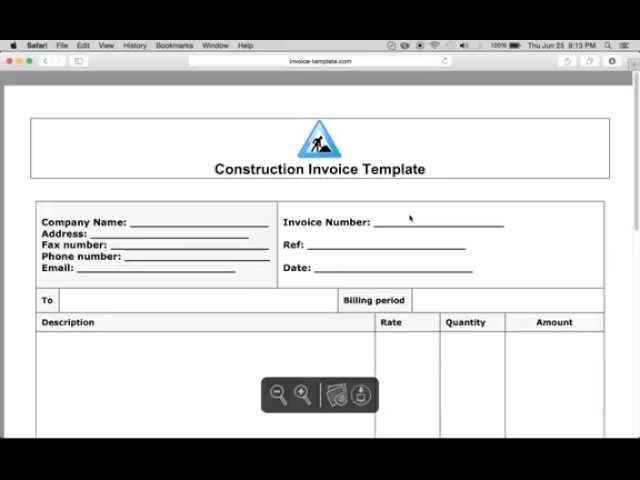

General Contractor Invoice Template

Key aspects of a general contractor invoice template are crucial for ensuring accurate billing and smooth payment processes in construction projects. These aspects encompass various dimensions, including:

- Contractor Information: Name, contact details, license number

- Client Information: Name, project address, contact details

- Invoice Number and Date: Unique identifier and date of issuance

- Description of Services: Clear and detailed breakdown of work performed

- Quantities and Unit Prices: Number of units and cost per unit

- Total Amount Due: Calculated sum of all charges

- Payment Terms: Due date, accepted payment methods, any discounts or penalties

- Notes and Attachments: Additional information, supporting documents

Understanding these key aspects helps contractors create professional and legally compliant invoices. Accurate contractor information ensures proper identification and communication. Clear client information facilitates timely payments and project coordination. Invoice numbers and dates provide a systematic record-keeping system. A detailed description of services eliminates confusion and disputes. Quantities and unit prices ensure transparency and accurate billing. The total amount due serves as a clear demand for payment. Payment terms establish expectations and minimize delays. Notes and attachments provide necessary context and supporting evidence. By incorporating these aspects, general contractors can streamline their invoicing process, enhance communication with clients, and maintain a professional image.

Contractor Information

Within the comprehensive structure of a general contractor invoice template, contractor information holds significant importance. It serves as the foundation for establishing the identity and credibility of the contractor, facilitating effective communication, and ensuring compliance with legal requirements.

- Contractor Name: The legal business name of the contracting entity, clearly identifying the provider of services.

- Contact Details: Accurate contact information, including address, phone number, and email address, enables prompt communication and facilitates project coordination.

- License Number: Displaying a valid license number demonstrates the contractor’s authorization to operate legally and meet industry standards, assuring clients of their professionalism and adherence to regulations.

Complete and up-to-date contractor information on an invoice template not only enhances the document’s professionalism but also ensures clear accountability and establishes a solid basis for billing and payment processes. It empowers clients to verify the legitimacy of the contractor, contact them for inquiries or clarifications, and have confidence in the services being rendered.

Client Information

Within the framework of a general contractor invoice template, client information holds paramount importance, establishing a clear line of communication and accountability between the contractor and the client. It encompasses three fundamental aspects:

- Client Name: Accurately identifying the client by their legal name ensures proper billing and correspondence, eliminating any potential confusion or misdirection.

- Project Address: Specifying the project address serves multiple purposes. It indicates the location where services were rendered, enabling accurate project identification and facilitating effective communication regarding the project site.

- Contact Details: Providing up-to-date contact information, including phone number, email address, and mailing address, allows for seamless communication throughout the project lifecycle. It enables prompt clarification of queries, timely updates on project progress, and efficient resolution of any .

Complete and precise client information on an invoice template not only enhances the document’s professionalism but also ensures clear accountability and establishes a solid foundation for billing and payment processes. It empowers clients to verify the accuracy of the invoice, contact the contractor for inquiries or clarifications, and have confidence in the services rendered.

Invoice Number and Date

Within the comprehensive structure of a general contractor invoice template, the invoice number and date serve as crucial elements, providing a unique identity and establishing a clear timeline for billing and payment processes. These two components play a pivotal role in ensuring efficient and organized invoicing practices.

- Unique Identifier: Each invoice issued by a contractor should carry a unique identifier, commonly referred to as the invoice number. It differentiates the invoice from all others, allowing for easy identification, tracking, and retrieval of specific invoices. This unique identifier helps contractors maintain systematic records and locate invoices promptly when needed.

- Date of Issuance: The invoice date indicates the day on which the invoice was created and sent to the client. It serves as a reference point for calculating payment due dates, resolving disputes, and maintaining accurate financial records. A clear and accurate invoice date is essential for both contractors and clients to manage their cash flow effectively.

- Timestamp for Services: The invoice date also serves as a timestamp for the services rendered or goods delivered. It provides a clear indication of the period covered by the invoice, helping to avoid confusion or discrepancies in billing. This timestamp is particularly important in cases where services are provided over an extended period.

- Legal Implications: In certain jurisdictions, the invoice date may have legal implications, influencing factors such as the statute of limitations for disputes or the calculation of interest on late payments. Understanding the legal significance of the invoice date is crucial for contractors to protect their rights and comply with applicable regulations.

In summary, the invoice number and date are indispensable elements of a general contractor invoice template. They provide a unique identity for each invoice, establish a clear timeline for billing and payments, serve as a timestamp for services rendered, and may have legal implications. By incorporating these components accurately and consistently, contractors can enhance the professionalism and efficiency of their invoicing practices.

Description of Services

Within the comprehensive structure of a general contractor invoice template, the description of services holds paramount importance, providing a clear and detailed account of the work performed. It serves as a crucial element in ensuring accurate billing, transparent communication, and effective project management.

- Scope of Work: The description of services should clearly outline the scope of work performed, including specific tasks, materials used, and any unique project requirements. This detailed description helps avoid misunderstandings and disputes, ensuring that both the contractor and the client have a shared understanding of the services rendered.

- Quantities and Units: When applicable, the description of services should include the quantities and units of work performed. This level of detail provides a precise understanding of the scale of the project and the resources utilized, enabling accurate pricing and billing.

- Labor Hours: For services that involve labor, the description should include the number of labor hours worked. This information is crucial for calculating labor costs and ensuring fair compensation for the contractor’s team.

- Materials and Equipment: If the project involves the use of materials or equipment, the description of services should include a list of these items, along with their quantities and any applicable rental or usage fees. This transparency helps clients understand the costs associated with materials and equipment.

By incorporating these facets into the description of services, general contractors can create invoices that are not only accurate and comprehensive but also enhance communication and build trust with their clients. Clear and detailed service descriptions minimize the potential for billing errors, disputes, and misunderstandings, ultimately contributing to a smooth and successful project execution.

Quantities and Unit Prices

Quantities and unit prices form the backbone of accurate billing in general contractor invoices. They provide a detailed breakdown of the work performed, ensuring transparency and facilitating fair compensation for the contractor.

- Itemized Services: Each service or task performed is listed separately, with its corresponding quantity and unit price. This itemization helps clients visualize the scope of work and understand the basis for the total cost.

- Material Costs: If the project involves the use of materials, the invoice should include a list of materials used, along with their quantities and unit prices. This transparency helps clients understand the material costs associated with the project.

- Labor Hours: For services that involve labor, the invoice should include the number of labor hours worked. This information is crucial for calculating labor costs and ensuring fair compensation for the contractor’s team.

- Equipment Rental: If specialized equipment was used during the project, the invoice should include details of the equipment rented, along with its rental period and cost per unit of time. This information ensures transparency and accurate billing for equipment usage.

By incorporating these details into the invoice, general contractors provide clients with a clear and comprehensive understanding of the work performed and the associated costs. This level of transparency minimizes the potential for disputes, promotes open communication, and fosters trust between contractors and clients.

Total Amount Due

Within the comprehensive framework of a general contractor invoice template, the total amount due represents the culmination of all charges associated with the services rendered. It serves as a critical focal point for both the contractor and the client, providing a clear understanding of the financial obligation and facilitating timely payment.

- Itemized Charges: The total amount due is a summation of all itemized charges listed on the invoice. This includes the cost of materials, labor, equipment rental, and any other applicable fees.

- Taxes and Fees: Depending on the jurisdiction, the total amount due may also include applicable taxes and fees. These charges are typically calculated as a percentage of the subtotal and must be clearly stated on the invoice.

- Discounts and Adjustments: In some cases, contractors may offer discounts or adjustments to the total amount due. These adjustments can be based on factors such as early payment, volume discounts, or negotiated terms. Any such discounts or adjustments should be clearly indicated on the invoice.

- Payment Terms: The total amount due is closely linked to the payment terms specified on the invoice. These terms outline the conditions and timelines for payment, including any penalties or incentives for early or late payments.

By presenting a clear and accurate total amount due, general contractors ensure transparency and facilitate efficient payment processing. This aspect of the invoice template not only serves as a financial summary but also sets the stage for clear communication and timely settlement of accounts.

Payment Terms

Within the comprehensive structure of a general contractor invoice template, payment terms hold significant importance, outlining the financial obligations and expectations between the contractor and the client. These terms clearly establish the due date for payment, acceptable payment methods, and any applicable discounts or penalties.

- Due Date: The due date specifies the date by which the payment is expected in full. Clearly stating the due date helps avoid confusion and ensures timely payments, preventing potential late fees or penalties.

- Accepted Payment Methods: The invoice should specify the accepted payment methods, such as checks, bank transfers, or online payment platforms. Providing multiple payment options offers convenience to clients and streamlines the payment process.

- Discounts: Some contractors may offer early payment discounts to incentivize timely payments. These discounts, if applicable, should be clearly stated on the invoice along with the terms and conditions for availing them.

- Penalties: Late payments may result in penalties or interest charges. The invoice should outline the consequences of late payments, including any applicable fees or interest rates. This transparency helps clients understand the financial implications of delayed payments.

By incorporating clear and comprehensive payment terms, general contractors set expectations, facilitate timely payments, and maintain a professional and organized invoicing process. These terms not only ensure financial clarity but also foster a positive and collaborative relationship between contractors and clients.

Notes and Attachments

Within the framework of a general contractor invoice template, the “Notes and Attachments” section serves as a valuable tool for providing additional information and supporting documentation. It allows contractors to convey important details, clarifications, or project-specific notes that may not fit within the standard invoice structure.

- Project Specifications: Contractors can use the notes section to include specific project specifications, such as materials used, building codes, or warranty information. This additional context helps clients fully understand the scope of work and the quality of materials used.

- Change Orders: When changes to the original project scope occur, contractors can attach change orders to the invoice. These documents provide a record of approved modifications, including any adjustments to the cost or timeline.

- Progress Reports: For ongoing projects, contractors may include progress reports as attachments. These reports provide clients with updates on the project’s status, completed milestones, and any potential challenges encountered.

- Inspection Certificates: In certain industries, such as electrical or plumbing work, contractors may attach inspection certificates to the invoice. These certificates verify that the work has been completed to code and meets industry standards.

By incorporating a “Notes and Attachments” section into their invoice templates, general contractors enhance communication, provide transparency, and streamline project management. These additional details and supporting documents help clients make informed decisions, track project progress, and ensure that the invoiced amount accurately reflects the work performed.

Frequently Asked Questions on General Contractor Invoice Templates

This section addresses common inquiries and clarifies aspects of general contractor invoice templates, empowering you with the knowledge to create professional and compliant invoices.

Question 1: What are the essential elements of a general contractor invoice template?

A well-structured invoice template should include contractor information, client information, invoice number and date, description of services, quantities and unit prices, total amount due, payment terms, and notes and attachments.

Question 2: Why is it important to have a clear description of services?

A detailed description helps avoid misunderstandings and disputes by providing a comprehensive account of the work performed, including materials used and labor hours.

Question 3: How should I handle change orders in my invoices?

Attach change orders to the invoice to document approved modifications and any adjustments to cost or timeline. This ensures transparency and keeps clients informed of project changes.

Question 4: What are the benefits of using a consistent invoice template?

Consistency enhances professionalism, simplifies record-keeping, and streamlines the invoicing process, making it easier for both contractors and clients to track payments and manage finances.

Question 5: Can I customize my invoice template to suit my specific needs?

Yes, you can customize the template to include additional sections or modify existing ones based on your business requirements and project types.

Question 6: What file formats are recommended for invoice templates?

Commonly used file formats for invoice templates include PDF, Word, and Excel. Choose a format that is compatible with your software and easy for clients to view and store.

These FAQs provide a foundation for understanding general contractor invoice templates. By incorporating these elements and adhering to best practices, contractors can create clear, accurate, and professional invoices that facilitate timely payments and foster positive client relationships.

In the next section, we will delve deeper into the legal considerations and best practices associated with general contractor invoice templates, ensuring compliance and protecting your interests.

Tips for Creating Effective General Contractor Invoice Templates

This section provides practical tips to help general contractors create effective invoice templates that streamline billing processes, minimize errors, and foster positive client relationships.

Tip 1: Use Clear and Concise Language: Ensure that the invoice is easy to understand and contains all necessary information without any ambiguity.

Tip 2: Include a Detailed Description of Services: Provide a comprehensive breakdown of the work performed, including materials used, labor hours, and any additional expenses.

Tip 3: Use Consistent Formatting and Numbering: Maintain a consistent layout and numbering system for all invoices to enhance readability and ease of tracking.

Tip 4: Set Clear Payment Terms: Outline the payment due date, accepted payment methods, and any applicable discounts or penalties for late payments.

Tip 5: Provide Contact Information: Clearly display the contractor’s contact information, including phone number, email address, and mailing address, for easy communication.

Tip 6: Use Cloud-Based Software: Utilize cloud-based invoicing software to automate the invoicing process, track payments, and generate reports.

Tip 7: Proofread Carefully: Before sending out invoices, thoroughly review them for any errors in calculations, descriptions, or other details.

By incorporating these tips into their invoice templates, general contractors can create professional and accurate invoices that facilitate timely payments, strengthen client relationships, and streamline their financial management.

In the concluding section, we will discuss best practices for managing and tracking invoices to ensure efficient cash flow and maintain a healthy financial position.

Conclusion

In summary, general contractor invoice templates play a critical role in streamlining billing processes, ensuring timely payments, and maintaining positive client relationships. This article has explored the key components, legal considerations, best practices, and tips for creating effective invoice templates.

A well-structured invoice template should clearly outline the services rendered, quantities, unit prices, payment terms, and contact information. It should adhere to legal requirements and industry standards to ensure compliance and protect the contractor’s interests. By incorporating these elements and following best practices, contractors can create professional and accurate invoices that facilitate efficient cash flow management.