A proforma invoice is a document that outlines the details of a transaction between a buyer and a seller, including a list of goods or services to be provided, their quantities, and prices. This document serves as a preliminary invoice that does not require payment until the goods or services have been delivered. It is commonly used in international trade to provide details of the goods or services to be exported or imported and their associated costs.

Proforma invoices are valuable tools for providing buyers with an accurate estimate of the total cost of a transaction, including any applicable taxes, duties, and shipping charges. They also play a crucial role in facilitating international trade by streamlining the process and reducing the risk of misunderstandings. Historically, the use of proforma invoices has been instrumental in promoting transparency and efficiency in global trade.

In this article, we will explore the various aspects of proforma invoices, including their elements, benefits, and legal implications. We will also provide practical tips for creating effective proforma invoices and discuss the documentation requirements for international trade.

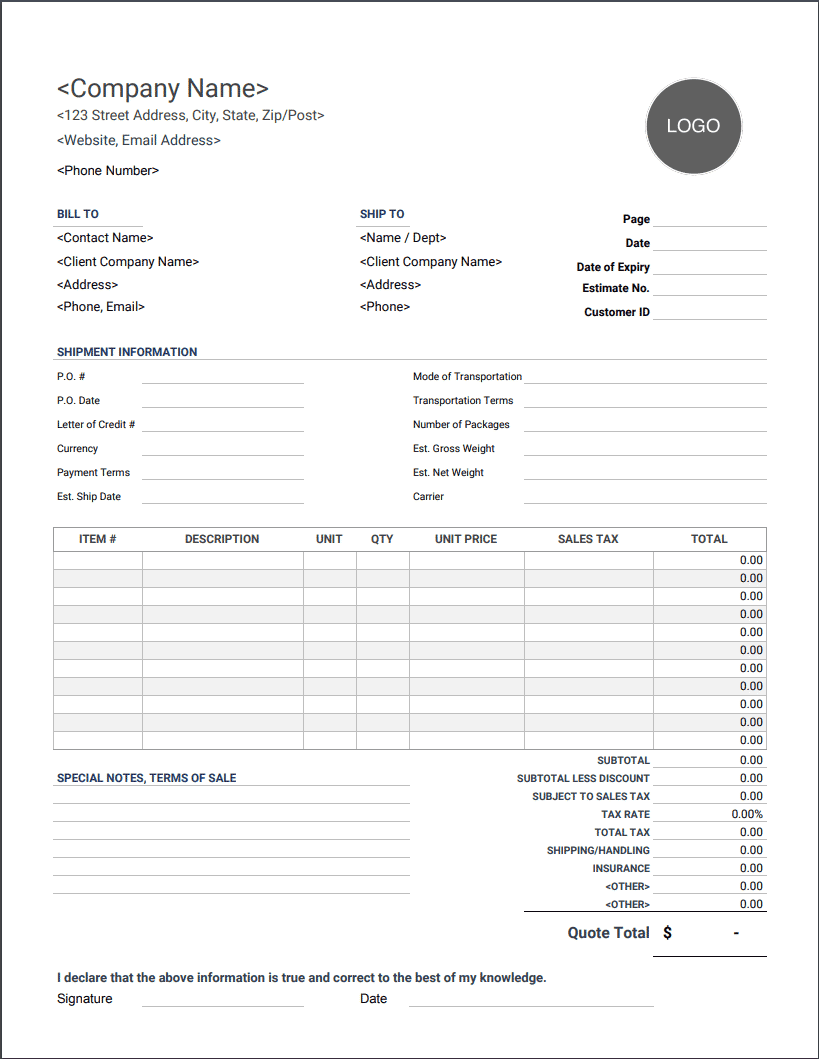

Performa Invoice Sample

Performa invoices are essential documents in international trade, providing a detailed outline of the goods or services to be transacted and their associated costs. Understanding the key aspects of a proforma invoice is crucial for ensuring a smooth and efficient trading process.

- Incoterms

- Description of goods

- Quantity

- Unit price

- Total amount

- Payment terms

- Delivery terms

- Validity period

- Legal compliance

- Digital signatures

These key aspects provide a comprehensive overview of the transaction, ensuring that both the buyer and seller have a clear understanding of the goods or services being traded, their costs, and the terms of the agreement. Proforma invoices facilitate international trade by providing a standardized format for communicating transaction details, reducing the risk of misunderstandings and disputes.

Incoterms

Incoterms, short for International Commercial Terms, are a set of standardized trade terms published by the International Chamber of Commerce (ICC) that define the responsibilities, costs, and risks involved in the delivery of goods from the seller to the buyer. They are widely used in international trade to facilitate clear communication and reduce the risk of misunderstandings and disputes between buyers and sellers. Proforma invoices, which outline the details of a transaction prior to the issuance of a commercial invoice, often incorporate Incoterms to specify the terms of delivery.

Incoterms are a critical component of proforma invoices as they determine who is responsible for arranging and paying for the transportation and insurance of the goods, as well as the point at which the risk of loss or damage to the goods transfers from the seller to the buyer. By including Incoterms in proforma invoices, buyers and sellers can clearly define their respective obligations and avoid potential disputes. For example, if the Incoterm “EXW” (Ex Works) is used, it indicates that the seller’s responsibility ends once the goods have been made available at their premises, and the buyer is responsible for arranging and paying for all aspects of the transportation.

Understanding the connection between Incoterms and proforma invoices is essential for businesses involved in international trade. By correctly incorporating Incoterms into proforma invoices, businesses can ensure that the responsibilities, costs, and risks associated with the delivery of goods are clearly defined, reducing the risk of misunderstandings and disputes. This understanding also enables businesses to make informed decisions about the most appropriate Incoterm to use for each transaction, based on factors such as the type of goods being traded, the mode of transport, and the level of risk involved.

Description of goods

The “Description of goods” section in a proforma invoice plays a critical role in ensuring the accuracy and clarity of the transaction. It provides a detailed description of the goods being traded, including their quantity, unit price, and total amount. This information is essential for both the buyer and seller to have a clear understanding of the goods being purchased and their associated costs.

A well-written description of goods should include specific details about the product, such as its make, model, size, color, and any other relevant characteristics. It should also clearly state the quantity of each item being purchased, as well as the unit price and total amount. By providing this information, proforma invoices help to avoid misunderstandings and disputes between buyers and sellers.

For example, a proforma invoice for the sale of computers might include the following description of goods: “10 units of Dell Optiplex 9020, Intel Core i5-10500, 8GB RAM, 256GB SSD, Windows 10 Pro 64-bit, at a unit price of $500.00, for a total amount of $5,000.00.” This description clearly specifies the type of computers being purchased, their specifications, quantity, unit price, and total amount.

Understanding the connection between the “Description of goods” and “performa invoice sample – https://simpleinvoice17.net/performa-invoice-sample/” is essential for businesses involved in international trade. By providing a detailed and accurate description of the goods being traded, proforma invoices help to ensure that both the buyer and seller have a clear understanding of the transaction, reducing the risk of misunderstandings and disputes. This understanding also enables businesses to make informed decisions about the goods they are purchasing or selling, based on factors such as the quality, price, and availability of the goods.

Quantity

In the context of proforma invoices, “Quantity” is a crucial aspect that specifies the number of units or the measurement of goods or services being traded. It plays a pivotal role in determining the total cost of the transaction and ensuring accurate fulfillment of the order.

-

Units

The quantity can be expressed in various units, such as pieces, dozens, kilograms, or liters, depending on the nature of the goods being traded. Clearly specifying the unit of measurement helps avoid confusion and ensures both parties have a shared understanding.

-

Accuracy

Accurate quantity information is essential to prevent discrepancies in the delivery and payment processes. Incorrect quantities can lead to misunderstandings, delays, and potential financial losses.

-

Partial Shipments

In certain cases, the total quantity ordered may be shipped in multiple installments. Proforma invoices should clearly indicate if partial shipments are allowed and specify the quantity included in each shipment.

-

Implications

The specified quantity in a proforma invoice has implications for various aspects of the transaction, including inventory management, logistics, and customs clearance. Accurate quantity information facilitates efficient planning and coordination throughout the supply chain.

Overall, understanding the significance of “Quantity” in proforma invoices is crucial for ensuring smooth and accurate international trade transactions. Proper attention to this aspect helps avoid errors, facilitates communication between buyers and sellers, and contributes to the overall efficiency of the trading process.

Unit price

Within the framework of proforma invoices, “Unit price” stands as a critical element that directly influences the calculation of the total amount payable for goods or services. It represents the monetary value assigned to a single unit of the specified quantity. Understanding the various aspects of “Unit price” is essential for accurate invoicing and seamless international trade transactions.

-

Base Price

The base price forms the foundation of the unit price, excluding any additional charges or discounts. It reflects the intrinsic value of the goods or services provided.

-

Quantity Discounts

In certain cases, sellers may offer discounts when buyers purchase larger quantities. These discounts are typically structured in tiers, with increased discounts for higher quantities ordered.

-

Currency Exchange Rates

When dealing with international trade, currency exchange rates play a significant role in determining the unit price. Fluctuations in exchange rates can impact the final cost of the goods or services.

-

Taxes and Duties

Depending on the jurisdiction and type of goods or services, taxes and duties may be applicable. These charges are often calculated as a percentage of the unit price and must be considered in the overall pricing.

In summary, “Unit price” encompasses various components that directly influence the total cost of a transaction reflected in a proforma invoice. These components include the base price, quantity discounts, currency exchange rates, and taxes/duties. Understanding and accurately calculating the unit price is crucial for both buyers and sellers to ensure fair and transparent pricing in international trade.

Total amount

Within the context of proforma invoices, “Total amount” stands as a crucial element that represents the cumulative monetary value of all goods or services being transacted. It serves as a summary of the total cost that the buyer is expected to pay the seller. Understanding the connection between “Total amount” and “performa invoice sample – https://simpleinvoice17.net/performa-invoice-sample/” is essential for accurate invoicing and meticulous trade practices.

The “Total amount” is calculated by multiplying the unit price of each item by its respective quantity and then summing up the values for all items listed on the proforma invoice. This calculation must be performed with precision to ensure that both the buyer and seller have a clear and accurate understanding of the total cost of the transaction.

Real-life examples of “Total amount” can be found in various industries, including manufacturing, retail, and international trade. For instance, in an international trade transaction, a proforma invoice for the shipment of electronic components might indicate a total amount of $10,000, representing the combined cost of all components, including any applicable taxes or duties.

Understanding the practical applications of “Total amount” is pivotal for businesses involved in international trade. It allows buyers to plan their financial resources effectively, ensuring that they have sufficient funds available to cover the total cost of the transaction. For sellers, it helps in managing their cash flow and ensuring timely payments. Accurate calculation of the “Total amount” also minimizes the risk of disputes or misunderstandings between buyers and sellers, fostering a smooth and mutually beneficial trading relationship.

Payment terms

Within the context of “performa invoice sample – https://simpleinvoice17.net/performa-invoice-sample/”, “Payment terms” stands as a critical aspect that outlines the agreed-upon conditions for settling the monetary obligations arising from the transaction. Understanding the various facets of “Payment terms” is essential for both buyers and sellers to ensure clarity, minimize risks, and facilitate smooth international trade operations.

-

Mode of payment

This refers to the specific method through which the payment will be made, such as bank transfer, wire transfer, letter of credit, or cash on delivery. Each mode of payment carries its own set of advantages and considerations, and the choice is often influenced by factors such as transaction value, payment security, and international regulations.

-

Payment timing

This specifies the time frame within which the payment is due. It can be expressed in terms of a specific number of days after the invoice date, after the delivery of goods, or after the acceptance of services. Clear payment timing expectations help avoid delays and potential disputes.

-

Partial payments

In certain cases, buyers and sellers may agree on a payment schedule that involves partial payments over a period of time. This arrangement can provide flexibility and accommodate specific cash flow requirements, but it also requires careful management and tracking to ensure timely completion of the payment obligation.

The aforementioned facets of “Payment terms” play a crucial role in shaping the financial aspects of international trade transactions. By understanding and agreeing on clear and mutually acceptable payment terms, buyers and sellers can minimize risks, streamline the payment process, and foster a mutually beneficial trading relationship.

Delivery terms

Within the context of “performa invoice sample – https://simpleinvoice17.net/performa-invoice-sample/”, “Delivery terms” constitute a critical aspect that outlines the agreed-upon conditions for the physical delivery of goods or services from the seller to the buyer. Understanding the various dimensions of “Delivery terms” is essential for both parties to ensure clarity, avoid disputes, and facilitate smooth international trade operations.

-

Mode of delivery

This specifies the method of transportation used to deliver the goods or services, such as airfreight, sea freight, or courier services. The choice of delivery mode is often influenced by factors such as the nature of the goods, urgency, and cost considerations.

-

Delivery schedule

This outlines the time frame within which the goods or services are expected to be delivered. It can be expressed in terms of a specific date or a range of dates, and is often subject to factors such as production lead times, shipping schedules, and customs clearance procedures.

-

Delivery location

This specifies the exact address or port where the goods or services are to be delivered. It is important to clearly indicate the final destination, as this may have implications for customs clearance, import duties, and local regulations.

-

Delivery charges

This refers to the costs associated with the delivery of the goods or services, such as freight charges, insurance premiums, and handling fees. These charges can be included in the total price of the transaction or billed separately.

The aforementioned facets of “Delivery terms” play a crucial role in shaping the logistics and transportation aspects of international trade transactions. By understanding and agreeing on clear and mutually acceptable delivery terms, buyers and sellers can minimize risks, optimize delivery schedules, and ensure that goods or services reach their intended destination in a timely and cost-effective manner.

Validity period

Within the context of “performa invoice sample – https://simpleinvoice17.net/performa-invoice-sample/”, “Validity period” holds significant importance as it establishes a time frame during which the invoice remains valid and the quoted prices, terms, and conditions are binding. Understanding this connection is critical for both buyers and sellers to ensure clarity, avoid disputes, and facilitate smooth international trade operations.

The validity period is typically specified on the proforma invoice and can range from a few days to several months, depending on the nature of the transaction, industry practices, and the level of risk involved. During this period, the buyer is expected to review the invoice, make necessary inquiries, and communicate any discrepancies or changes to the seller. Once the validity period expires, the proforma invoice becomes null and void, and a new invoice may need to be issued if the transaction is still being pursued.

Real-life examples of “Validity period” within “performa invoice sample – https://simpleinvoice17.net/performa-invoice-sample/” can be found in various industries, including manufacturing, retail, and international trade. For instance, in an international trade transaction, a proforma invoice for the shipment of electronic components might indicate a validity period of 30 days. This means that the buyer has 30 days to review the invoice, confirm the order, and make the payment before the prices and terms become subject to change.

Understanding the practical applications of “Validity period” is pivotal for businesses involved in international trade. It allows buyers to plan their purchasing decisions and secure the goods or services at the agreed-upon prices and terms. For sellers, it provides a clear timeline for order confirmation and payment, helping them manage their cash flow and production schedules effectively. Furthermore, a well-defined validity period minimizes the risk of misunderstandings, disputes, and potential legal complications arising from outdated or expired invoices.

Legal compliance

Within the context of “performa invoice sample – https://simpleinvoice17.net/performa-invoice-sample/”, “Legal compliance” assumes immense significance as it encompasses the adherence to applicable laws and regulations governing international trade transactions. Understanding this connection is crucial for businesses to operate ethically, avoid legal pitfalls, and maintain a positive reputation.

-

Accuracy and Transparency

Performa invoices must accurately reflect the agreed-upon terms of the transaction, including the description of goods, quantity, unit price, and total amount. Misrepresentation or omission of information can lead to legal complications and disputes.

-

Compliance with Tax Regulations

Businesses must adhere to tax laws and regulations applicable to international trade. This includes the correct calculation and reporting of taxes, such as value-added tax (VAT) or import duties. Non-compliance can result in penalties and legal consequences.

-

Intellectual Property Rights

Performa invoices should respect intellectual property rights, such as copyrights, trademarks, and patents. Selling or distributing goods or services that infringe on intellectual property rights can lead to legal claims and penalties.

-

Anti-Corruption Laws

Businesses must comply with anti-corruption laws and regulations, both domestically and internationally. Offering or accepting bribes or engaging in corrupt practices can result in severe legal consequences and reputational damage.

By ensuring “Legal compliance”, businesses can safeguard their interests, build trust with customers and partners, and contribute to fair and ethical international trade practices. Neglecting legal requirements can have serious consequences, including financial penalties, legal liability, and damage to reputation. Therefore, it is imperative for businesses to prioritize legal compliance throughout their international trade operations.

Digital signatures

Within the realm of international trade, “Digital signatures” have emerged as a critical component of “performa invoice sample – https://simpleinvoice17.net/performa-invoice-sample/”, playing a pivotal role in enhancing the security, authenticity, and legal validity of these documents. A digital signature is an electronic representation of an individual’s or organization’s unique identity, used to validate the authenticity and integrity of digital documents, including proforma invoices.

By incorporating digital signatures into proforma invoices, businesses can ensure that the information contained within the document remains unaltered and originates from the intended sender. This is particularly important in international trade, where proforma invoices serve as the basis for financial transactions and legal agreements between parties located in different jurisdictions. Digital signatures provide a secure and tamper-proof method of verifying the authenticity of the invoice, reducing the risk of fraud and disputes.

Real-life examples of “Digital signatures” within “performa invoice sample – https://simpleinvoice17.net/performa-invoice-sample/” can be found across various industries engaged in international trade. For instance, in the electronics industry, manufacturers use digital signatures to validate proforma invoices for the export of components to overseas buyers. By employing digital signatures, they can ensure that the invoices are genuine and have not been tampered with, safeguarding both the buyer and the seller from potential fraud or legal issues.

Understanding the practical applications of “Digital signatures” within “performa invoice sample – https://simpleinvoice17.net/performa-invoice-sample/” is crucial for businesses involved in international trade. By implementing digital signatures, businesses can enhance the security and legal validity of their proforma invoices, streamline their invoicing processes, and build trust with their trading partners. Digital signatures contribute to the overall efficiency, transparency, and reliability of international trade transactions.

Frequently Asked Questions (FAQs)

This section aims to address common queries and clarify aspects of “performa invoice sample – https://simpleinvoice17.net/performa-invoice-sample/” to enhance understanding and practical implementation.

Question 1: What is the purpose of a proforma invoice?

A proforma invoice is a preliminary invoice issued before the delivery of goods or services. It outlines the details of the transaction, including the description of goods, quantity, unit price, and total amount, serving as a basis for payment upon fulfillment.

Question 2: What are the key elements of a proforma invoice?

Essential elements include the seller’s and buyer’s information, invoice number and date, description of goods or services, quantity, unit price, total amount, payment terms, delivery terms, and validity period.

Question 3: How does a proforma invoice differ from a commercial invoice?

A proforma invoice is a preliminary document used for informational purposes and payment arrangements, while a commercial invoice is issued after the delivery of goods or services and serves as the basis for actual payment.

Question 4: What is the legal validity of a proforma invoice?

A proforma invoice is not legally binding and does not create an obligation to pay. However, it serves as a binding agreement once both parties sign and accept its terms.

Question 5: Can a proforma invoice be modified?

Yes, a proforma invoice can be modified before it is accepted by the buyer. Any changes must be communicated and agreed upon by both parties.

Question 6: What are the benefits of using a proforma invoice?

Proforma invoices facilitate international trade by providing a clear understanding of the transaction details, reducing the risk of misunderstandings and disputes, and streamlining the payment process.

These FAQs provide a concise overview of key aspects related to “performa invoice sample – https://simpleinvoice17.net/performa-invoice-sample/”. By addressing common questions, we aim to equip readers with a solid understanding of proforma invoices and their practical applications in international trade. In the following section, we will delve deeper into specific scenarios and provide practical guidance on creating and using proforma invoices effectively.

Transition to the next section: Creating a Proforma Invoice: A Step-by-Step Guide

Tips for Creating Effective Proforma Invoices

Proforma invoices are essential tools in international trade. By following these tips, businesses can create clear, accurate, and legally compliant proforma invoices that facilitate smooth transactions and minimize the risk of disputes:

Tip 1: Include all essential elements

Ensure that the proforma invoice includes all the key elements, such as the seller’s and buyer’s information, invoice number and date, description of goods or services, quantity, unit price, total amount, payment terms, delivery terms, and validity period.

Tip 2: Use clear and concise language

The proforma invoice should be easy to understand and interpret. Avoid using ambiguous or technical terms that may lead to confusion.

Tip 3: Proofread carefully

Before sending the proforma invoice to the buyer, proofread it carefully to ensure that there are no errors in the information, calculations, or formatting.

Tip 4: Use a consistent format

Maintaining a consistent format for all proforma invoices helps ensure clarity and professionalism. Consider using a template or invoice software to streamline the process.

Tip 5: Get legal advice if needed

If there are any complex legal issues involved in the transaction, consider consulting with an attorney to ensure that the proforma invoice is legally compliant.

By following these tips, businesses can create effective proforma invoices that accurately reflect the terms of the transaction and minimize the risk of disputes. Clear and accurate proforma invoices are essential for building trust between buyers and sellers and facilitating smooth international trade.

In the next section, we will explore the legal implications of proforma invoices and provide guidance on how to ensure compliance with applicable laws and regulations.

Conclusion

This article has explored the various aspects of “performa invoice sample – https://simpleinvoice17.net/performa-invoice-sample/,” highlighting its importance in international trade and providing practical guidance on its creation and use. Key points discussed include the essential elements of a proforma invoice, the benefits of using a proforma invoice, and tips for creating effective proforma invoices.

Proforma invoices play a crucial role in facilitating international trade by providing a clear understanding of the terms of the transaction and minimizing the risk of disputes. By following the tips outlined in this article, businesses can create professional and legally compliant proforma invoices that accurately reflect the agreed-upon terms of the sale.